As we close out the second quarter of 2025, the residential real estate market continues to navigate an uncertain landscape shaped by persistent affordability issues, constrained inventory and mixed buyer sentiment.

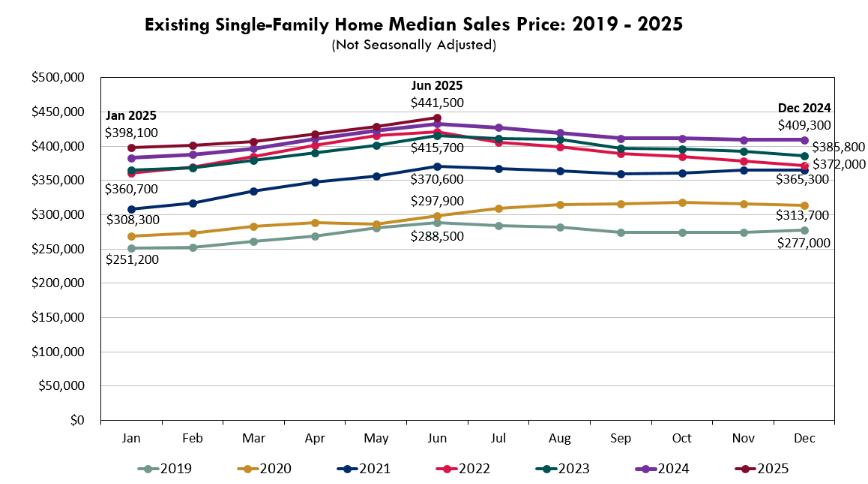

The good news for our senior living prospects is that prices remain elevated, and, in fact, hit their highest level ever in June.

However, the annual pace of homes sold continues to stay relatively flat during 2025, and the supply of homes for sale has increased to its highest level since June of 2019, indicating a slowing demand for homes that just continue to get more expensive.

Sales Activity: A Modest Rebound, but Still Below Pre-Pandemic Norms

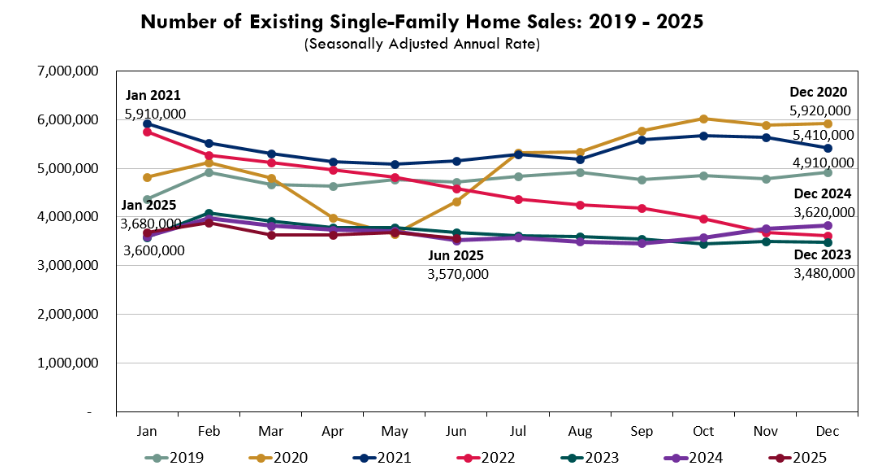

The number of existing single-family home sales in June 2025 came in at 3.57 million (seasonally adjusted annual rate), representing a slight year-over-year increase of 50,000 homes, or approximately 1.4%. What we are not seeing, though, is the sharp increase in home sales that typically happens during the spring and early summer months. In fact, June sales were actually slightly lower than in January, which is highly unusual.

While current sales volumes remain well below historic norms from just four years ago, when they exceeded 5 million homes per year, they have remained remarkably consistent over the past three years, ever since mortgage rates jumped up to their current levels of between 6.5% and 7.5%.

Home Prices: Record Highs Continue Despite Sluggish Sales

In a continued trend from Q1, home prices reached record highs once again. The median resale value for existing single-family homes hit a new milestone in June 2025, reaching $441,500. As NAR Chief Economist Lawrence Yun pointed out, “Multiple years of undersupply are driving the record high home prices. Home construction continues to lag population growth.”

This limited inventory has kept prices high. For seniors looking to sell, this continues to represent a rare opportunity to maximize home equity, especially for those who bought prior to 2015 and have seen double-digit gains in home value over the last decade.

Dr. Yun emphasizes this point, noting, “The average homeowner’s wealth has expanded by $140,900 over the past five years.” For many seniors, that equity boost is more than enough to ensure their home value can fund a move into a Life Plan Community without the need to rely on other liquid assets. In fact, it’s leading many new Life Plan Community residents to select larger, more expensive residences than ever before.

Inventory & Supply: More Homes Available, But Still a Seller’s Market

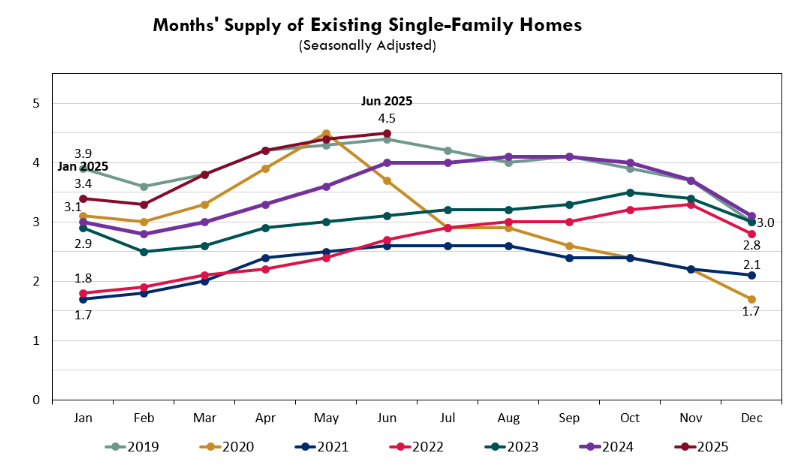

Another critical metric to watch is inventory. By the end of June 2025, months’ supply of existing single-family homes rose to 4.5 months—up from 4.0 months the year prior.

This means that, on average, it is taking our prospects longer to sell their homes as more homes come on the market, but the sales pace does not increase. That said, we are still in a faster resales period than the 5- to 6-month supply level traditionally associated with a balanced market.

Mortgage Rates: Stability at High Levels Holds Back Market Expansion

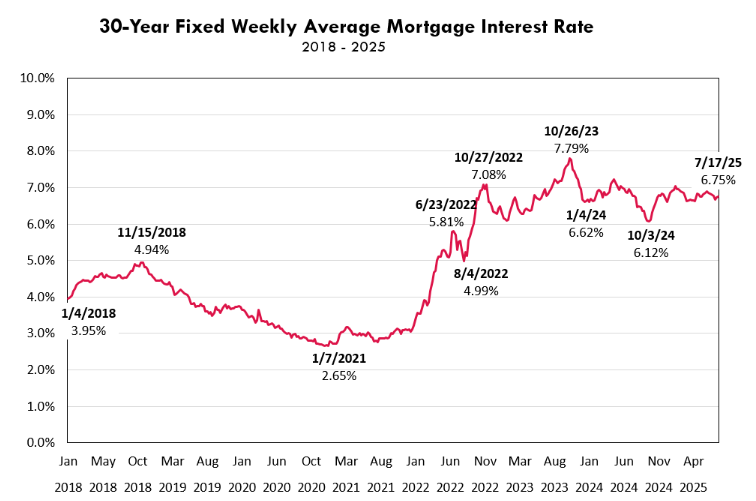

Freddie Mac reports that the average 30-year fixed mortgage rate held steady at 6.75% as of July 17. While this represents a nearly 1% decrease from its 2023 peak, rates remain stubbornly high by recent historical standards.

The Federal Reserve has not made significant cuts in interest rates since reducing them to 4.25% in December 2024, and market expectations are mixed on whether further reductions will occur this year.

These high borrowing costs continue to suppress overall transaction volumes, particularly among first-time homebuyers. As Dr. Yun explains, “High mortgage rates are causing home sales to remain stuck at cyclical lows. If the average mortgage rates were to decline to 6%, our scenario analysis suggests an additional 160,000 renters becoming first-time homeowners and elevated sales activity from existing homeowners.”

The takeaway? If rates drop modestly later this year—as some predict—we could see a spike in overall demand, which could benefit sellers currently on the sidelines and increase the speed of resales.

Implications for Seniors Considering a Move to a Life Plan Community

For seniors contemplating a move into a Life Plan Community, the current market conditions continue to present a mixed but largely positive picture:

- Equity Opportunity: With prices at record highs, this remains an ideal time to sell from an equity-maximization standpoint. Many older homeowners can realize substantial gains that will go a long way toward funding entrance fees and monthly service costs in a Life Plan Community.

- Sales Timeline: While some higher-end homes or properties in slower-moving markets may take a bit longer to sell than a year ago, most well-priced homes are still closing in 30 to 45 days. Seniors should continue to work with real estate agents who understand the senior market and can price appropriately to avoid unnecessary time on the market.

- Affordability for Buyers: The biggest drag on the market remains affordability, but this mostly affects first-time homebuyers. For seniors who are sellers, that buyer pool may be thinner—but not absent.

- Looking Ahead: The broader economy—including employment levels, inflation, and any changes in trade policy such as tariffs—will continue to influence the housing market. Any sign of a rate cut by the Fed in the second half of the year could inject new momentum into home sales, benefitting senior sellers and simplifying the transition into senior living.

As Dr. Yun concludes, “Expanding participation in the housing market will increase the mobility of the workforce and drive economic growth.” The same holds true for seniors: improved mobility in the real estate market supports life transitions that benefit both individual households and the broader economy.

Final Thoughts

For seniors and their families, the current market offers a strong selling opportunity—particularly for those who have been in their homes for 10 years or more. While sales remain slower than historical norms, prices are at all-time highs. With careful timing and planning, this environment continues to support smooth transitions into Life Plan Communities.

As always, we will continue monitoring these developments closely. Look for our next real estate market update at the end of the third quarter.

For additional longer-term insights on the housing market and its impact on senior living, please see our earlier articles in this series, including the in-depth analysis of six key performance indicators we originally published in February 2023, the overall look back on 2023 we shared in February 2024 or the overall look back on 2024 we published this past February.