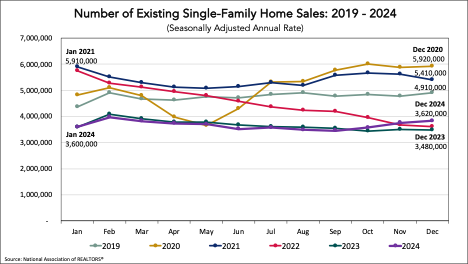

As 2024 wound down to its end, the real estate market showed some promising signs of recovery despite the challenges faced throughout the year. Per the National Association of Realtors® (NAR) January report on December sales, December 2024 ended on a positive note, with existing-home sales rising to a seasonally adjusted rate of 4.24 million, the strongest pace since February 2024. This represents a 9.3% increase from one year ago, marking the largest year-over-year gain since June 2021.

According to NAR Chief Economist Lawrence Yun, “Home sales in the final months of the year showed solid recovery despite elevated mortgage rates. Home sales during the winter are typically softer than the spring and summer, but momentum is rising with sales climbing year-over-year for three straight months. Consumers clearly understand the long-term benefits of homeownership. Job and wage gains, along with increased inventory, are positively impacting the market.”

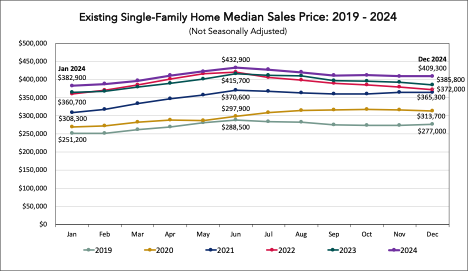

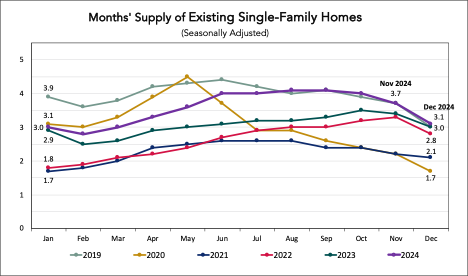

Even with this solid upturn in the fourth quarter, on an annual basis, existing-home sales fell to the lowest level in nearly 30 years, while the median price reached a record high for December of $407,500 in 2024. The inventory of unsold existing homes dropped 13.5% from the previous month to 1.15 million at the end of December, or the equivalent of 3.3 months’ supply at the current monthly sales pace. Properties typically remained on the market for 35 days in December, up from 32 days in November and 29 days in December 2023.

Supporting Graphs

Existing-Home Sales: The graph shows a steady increase in home sales toward the end of 2024, indicating a recovery in the market. The year-over-year growth of 9.3% in December highlights the resilience of the housing market despite higher mortgage rates.

Median Home Resale Price: The median home resale price reached a record December high of $407,500 in 2024, reflecting strong demand and limited supply. This trend is expected to continue into 2025, with home prices remaining elevated.

Inventory Levels: The inventory of unsold homes decreased significantly in December, suggesting that homes are selling faster than new listings are coming onto the market. If this trend continues into 2025, it could lead to increased competition among buyers and more price increases.

More Recent Uncertainty in the 2025 Home Resales Market

Despite the positive outlook from the NAR last November, the outlook since the new administration took office in mid-January has changed, with economists having more concerns about the potential for lower interest rates and a market rebound in 2025.

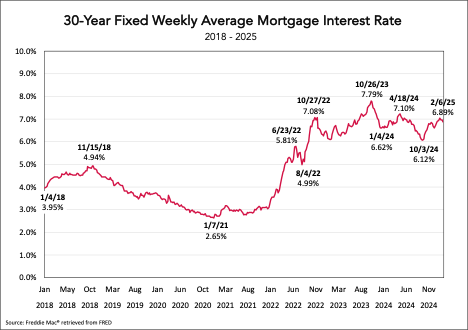

According to J.P. Morgan’s January report, The Outlook for the US Housing Market in 2025, house prices are expected to rise by 3% overall in 2025. However, the higher-for-longer interest rate backdrop is here to stay, with the firm projecting that mortgage rates are expected to ease only slightly to 6.7% by the year end. This is a significantly more conservative projection than the NAR’s projection from November, which predicted rates would fall to closer to 6% by year end.

The graph below shows that, despite expectations that the Fed funds rate may fall further in 2025, interest rates in January and early February have actually been increasing.

Per J.P. Morgan’s Head of Securitized Products Research John Sim, President Trump’s policies could have complex implications for the housing market, particularly on the issue of affordability. “By reducing immigration and lessening demand, Trump argues that housing costs can be reduced,” Sim said. “It’s not that simple, though — approximately 30% of construction workers are immigrants, so there could be complex implications. Cutting immigration would mean cutting labor supply in the construction industry, which could end up exacerbating the lack of affordable housing.”

J.P. Morgan’s report also notes that several of Trump’s proposals could lead to rising inflation, which is likely to result in higher mortgage rates that would further dampen housing demand. For example, government-sponsored enterprise (GSE) privatization — which includes the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal National Mortgage Association (Fannie Mae) — could widen mortgage-backed security (MBS) spreads and lead to even higher rates for borrowers.

“It’s evident that numerous aspects of Trump’s policy will impact the housing market,” Sim said. “For now, though, all we can do is wait.”

Impact on Senior Living

While the uncertainty in the home resales market may not be great for the economy overall, it could have a silver lining for the senior living sector. Continuing high home values would enable senior living prospects to sell their homes at a good price, making it more affordable for them to move into a senior living community. This could provide a stable source of demand for senior living facilities, even in a challenging economic environment.

In conclusion, while the real estate market ended 2024 on a positive note and the projections for 2025 were initially optimistic, several factors could introduce uncertainty into the market. It will be important to monitor these developments closely and adjust strategies accordingly.

For additional longer term insights on the housing market and its impact on senior living, please see our earlier articles in this series, including the in-depth analysis of six key performance indicators we originally published in February 2023, or the overall look back on 2023 we shared in February 2024.