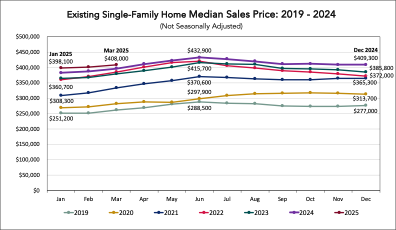

As we moved through the first quarter of 2025, the real estate market continued to face challenges and shifts. Existing-home sales for all housing types (including condos) have slowed by 2.4% compared to one year ago. Despite this slowdown, the median existing-home sales price for all homes has climbed 2.7% from March 2024 to $403,700 in March 2025. This marks an all-time high for the month of March and the 21st consecutive month of year-over-year price increases.

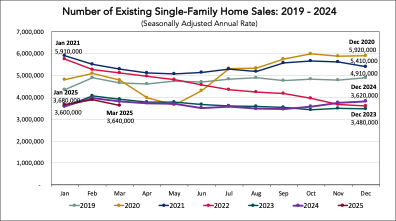

The following chart shows the total number of resales for just existing single-family homes for the first quarter. After an uptick in February, the number of sales dropped in March.

The chart below shows the updated resale value just for existing single-family homes, which also reached an all-time high for March of $408,000.

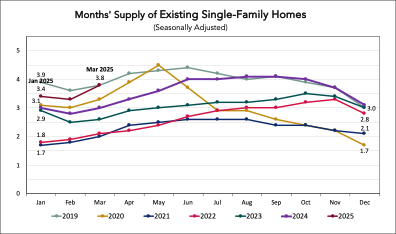

The inventory of all unsold existing homes jumped 8.1% from the previous month to 1.33 million at the end of March. This represents the equivalent of 4.0 months’ supply at the current monthly sales pace.

Focusing just on existing single-family homes, the months’ supply also increased, reaching 3.8 months, again indicating a slowing of sales.

“Home buying and selling remained sluggish in March due to the affordability challenges associated with high mortgage rates,” NAR Chief Economist Lawrence Yun said. “Residential housing mobility, currently at historical lows, signals the troublesome possibility of less economic mobility for society.”

According to the monthly REALTORS® Confidence Index, properties typically remained on the market for 36 days in March. This is down from 42 days in February but up from 33 days in March 2024.

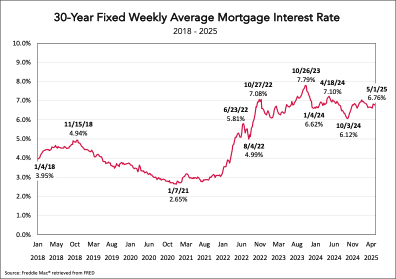

Freddie Mac reports that the 30-year fixed-rate mortgage averaged 6.76% as of May 1. This is down from 6.94% from one year ago. Despite the Federal Reserve dropping interest rates from 5.25% in August 2024 to 4.25% in December 2024, mortgage rates have continued to increase over these past seven months. This indicates a lack of confidence in the Fed significantly reducing rates further in 2025.

Impact on Senior Living

While continuing high home values enable senior living prospects to sell their homes for all-time high prices, sales are beginning to slow even further. Most homes are still selling in not much more than a month, but some of our prospects’ higher value homes could see more time on the market.

What will be especially interesting to continue to watch is the impact potential tariffs have on the economy overall, and whether that leads to the Fed tightening or loosening the money supply. That could have a significant impact on either opening up the real estate market or tightening it even further as the year goes on.

As always, stay tuned for more updates.

For additional longer term insights on the housing market and its impact on senior living, please see our earlier articles in this series, including the in-depth analysis of six key performance indicators we originally published in February 2023, the overall look back on 2023 we shared in February 2024 or the overall look back on 2024 we published this past February.