By Sara Montalto, Senior Vice President, Strategic Services

With margins continually getting squeezed by inflation and rising payroll costs, senior living communities need to find new ways to increase top-line revenue. Here are three strategies most communities could implement virtually immediately—plus one with longer term potential—without having to rely on significant (and painful!) monthly fee increases.

Home Resale Value Increases Have Created Opportunities for Communities

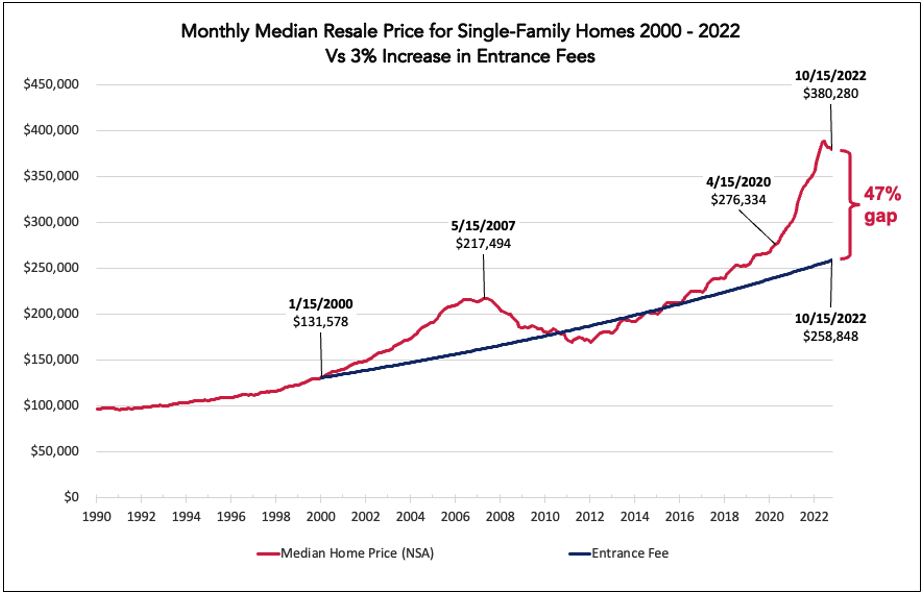

To set the stage for our recommendations, let’s first look back at some information Rob Love shared in his December blog, “Four Strategies to Build Revenue and Strengthen Staff Recruiting.”

Since 2013-14, when home values recovered from the 2007 crash to align once again with historical trends, home value increases have steadily outgained typical entrance fee increases, which have averaged around 3% for much of the past decade. By the fall of 2022, the median home resale value in the U.S. reached just over $380,000. By comparison, if—in the year 2000—a hypothetical community’s average entrance fee was in line with home values, and it then steadily increased its entrance fees by 3% a year, by late 2022 it would have an average entrance fee of just under $260,000—a 47% gap from the median home resale value! This creates a significant opportunity for communities to adjust their entrance fees.

Strategy #1: Increase Entrance Fees

If the hypothetical community in the example above had an average monthly fee of $4,000 in 2022 and increased its fees by 8% for 2023 to keep up with inflation, the average increase would be $320/month, or $3,840/year.

Alternatively, if the community increased its entrance fee by only half of the differential (23.5%) in the above graph, its average entrance fee would increase by nearly $61,000. This would generate more cash from a single sale than the community would get from about 16 residences that had 8% monthly fee increases.

By blending both strategies—using the increases in housing values to significantly increase entrance fee revenue, while increasing monthly fees at levels closer to typical annual levels (say 4% to 5% instead of the historical 3%)—communities can 1) significantly increase overall revenues, 2) ease the burden on existing residents, and 3) better cover their inflationary costs and meet their debt service covenant requirements.

Strategy #2: Increase Fees for the Most In-Demand Residences

Almost invariably when we look at communities’ marketing programs, there is a solid wait list of prospects for the community’s larger residences, but a dearth of prospects for its smaller ones. This leads to developing and implementing strategies to make the smaller residences more appealing, which sometimes includes price reductions or incentives.

But let’s look at that situation through a different lens. A community in such a situation has a supply and demand imbalance, and not just for the smaller residences. When demand for the larger residences exceeds supply, that is an opportunity to increase entrance and/or monthly fees for those most in-demand residences. Not only will this increase revenue from those residences, but it can also lead some prospects to select one of the smaller residences instead, helping to address that challenge as well.

Strategy #3: Implement Individual Residence Pricing

This is a strategy we’ve been implementing at communities for nearly 20 years with consistently positive results. Think of it this way: If you have two of the same residence type available, and one of them has a beautiful view while the other overlooks a parking lot, why should they be priced the same? Yet, in many communities (and I dare say “most”), they are.

With an individual residence pricing strategy, every independent living residence in a community is evaluated to determine its strengths and weaknesses on a variety of issues that are important to residents and prospects at that community. Typical influencing factors are the view, floor level, distance from amenities, and balcony and/or walkout patio options.

The community then assigns a value to each factor that reflects the importance residents and prospects place on each. For example, a residence with a great view may have its entrance fee increased by 10%, while one with a very poor view will get a 10% reduction. After considering all the factors, each residence winds up with its own unique price point.

When we’ve implemented these programs at communities, we always structure the ratings to result in a net increase in potential entrance fee revenue for the community. In some cases, the potential additional entrance fee revenue from all of the adjustments to all of the residences has been as much as $5 to $10 million.

Strategy #4: Modify Contract Options

There are many opportunities to impact margins by adjusting a community’s various contract options. Many of them tend to have more of a longer term impact on margins than an immediate impact, but they are still good options to consider.

A few of the more typical modifications we’ve observed are:

- Decreasing the refundability of a high-refund contract option, such as from 90% to 80%, while keeping the entrance fee the same

- Streamlining the benefits offered under lifecare or modified contract options, especially if your community’s contracts are more service-rich than competitors in your market

- Changing the differential between refund options to influence consumer selection

- For example, if the difference between a declining balance entrance fee and a 90% refundable entrance fee is reduced from 85% to 60%, consumers will show significantly more interest in the higher refund plan, which creates more entrance fee revenue. (Be cautious with this strategy, though, as it has some significant downsides.)

- From the opposite perspective, increasing the differential between a declining balance entrance fee and a 90% refundable entrance fee from 60% to 85% will significantly decrease interest in the higher refund option. Although this may result in lower entrance fees in the short run, declining balance entrance fees consistently generate stronger cash positions over longer periods of time.

Steps to Ensure You Remain Competitive While Increasing Revenue

There are four steps to ensure that your contract modifications don’t put you at a competitive disadvantage:

- Conduct a competitive pricing analysis, looking at the lifetime cost of living at each community to get an accurate comparison of differing contract options.

- Conduct a competitive positioning analysis (often done in conjunction with the pricing analysis) to determine the relative value offered by your community and your competitors.

- Conduct a home value analysis to determine the median home resale value in your market area, and then compare that to your entrance fees.

- Complete an internal pricing analysis to identify opportunities to modify how your residences and contracts are priced relative to each other.

We will explore each of these steps during our upcoming webinar.

If you would like to talk through any of these opportunities in more detail, please reach out to Sara Montalto or Tim Bracken. We look forward to sharing more on these and other topics in our upcoming webinar.