By Tom Mann, Principal

The reasons for growth

Watch the recording of our “The Reasons for Growth” webinar featuring experts from LeadingAge, HumanGood, and Asbury!

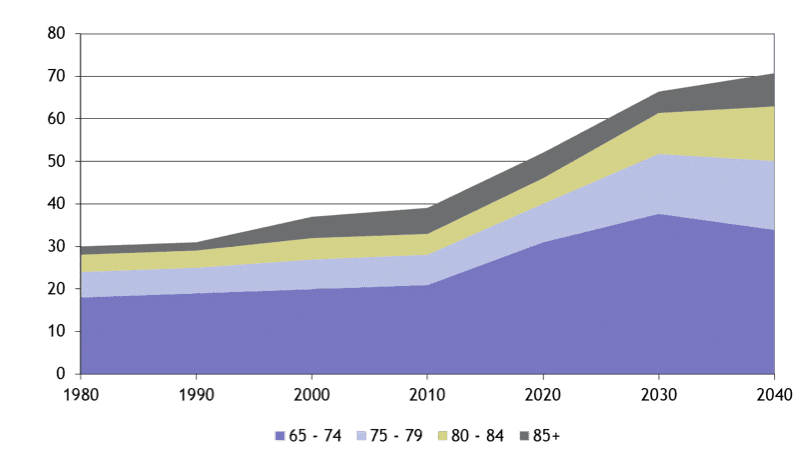

We all know this chart…

Credit: US Census and Ziegler

… more than 76 million baby boomers will start making their post-retirement life choices starting in 2025. The value of reminding us that the wave is almost to our customers’ age is to illustrate the growth needed…and the change needed!

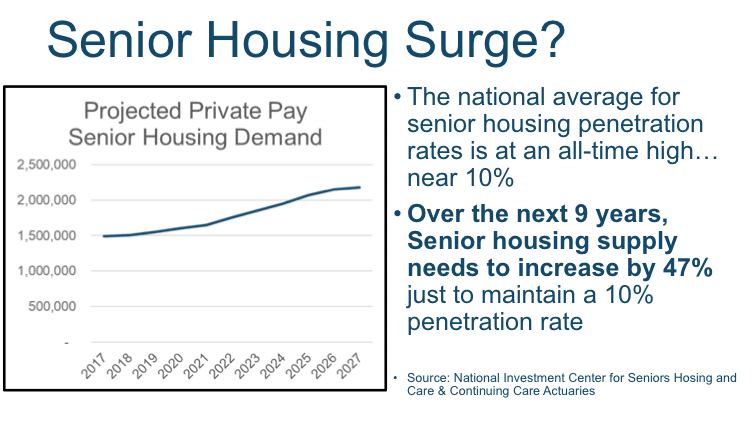

This chart, which is from a PowerPoint that Brad Paulis of Continuing Care Actuaries shared at LeadingAge’s 2017 annual meeting, shows that nationally senior housing is at a 10% penetration rate. Just to keep up with that level of demand as we move forward, we need to increase our inventory by another 47%! So here’s an important question for those of us in the senior housing field: “Can we add 47% in the next nine years?” Think about this question. According to Perry Aycock of K4Connect, currently about 1,961 communities have approximately 600,000 residences. An increase of demand by 47% (just to maintain a penetration rate of 10%) would require adding roughly 282,000 residences. At roughly $250 per square foot, that totals about $67 trillion (or roughly $240,000 per resident). In short, plenty of opportunities abound for senior living providers in the coming years.

“Without continual growth and progress, such words as improvement, achievement and success have no meaning.” – Benjamin Franklin

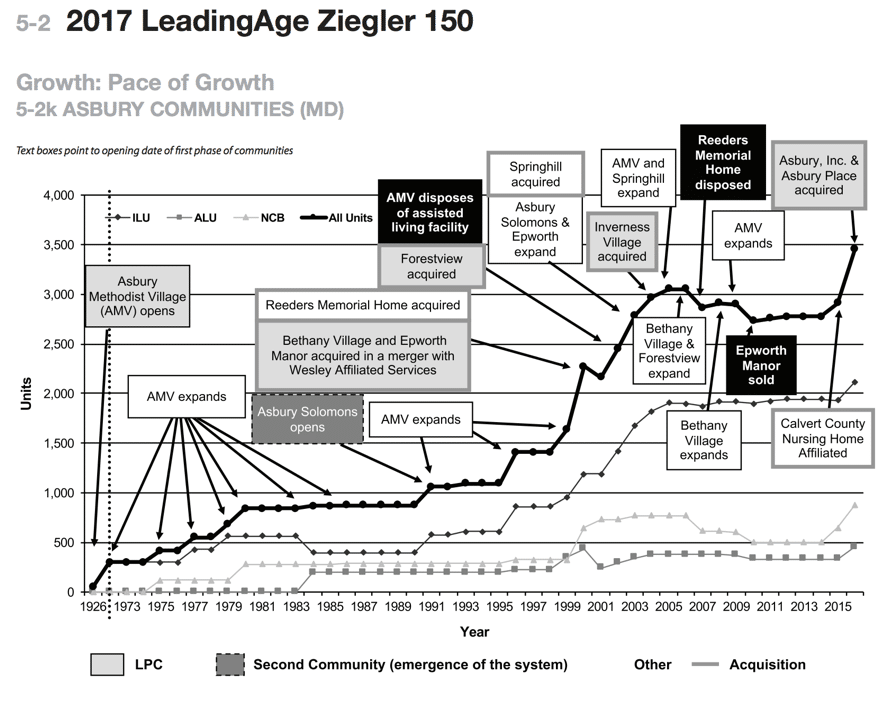

One reason for highlighting Asbury throughout this blog series is its aggressive plans to change how Americans age. Asbury’s CEO Doug Leidig outlines his organization’s smart growth goals:

- Increase the number of residents and clients served

- Expand the system of affiliates to improve system efficiencies

- Enhance amenities offered to residents and clients

- Reduce (improve) operating ratio (OR)

- Build financial reserves

- Strengthen each affiliate’s market brand

- Reduce exposure to healthcare revenue

- Develop mutually beneficial relationships with strategic business partners

- Expand our talent pool and areas of expertise

The last of those nine goals, Expand our talent pool and areas of expertise, in my mind really speaks to Asbury’s desire to grow through expansion of partnerships, service lines and affiliations.

Partnerships

“[Partnerships provide] a unique opportunity for incremental growth, increased profitability and the opportunity for us to serve, connect with and become part of the daily ritual of an even larger base of consumers.” – Howard Schultz, CEO, Starbucks

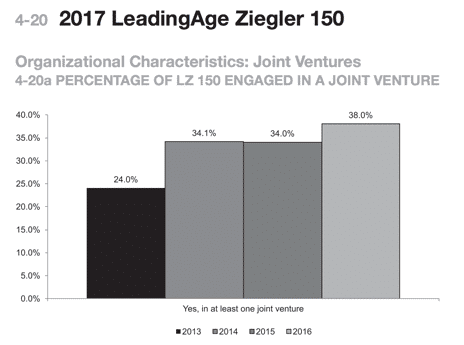

Wall Street has long known the power of strategic alliances. However, the not-for-profit DNA of senior living has often resulted in a hesitancy toward partnerships outside of the industry’s core services. An article by Geoff Baum in an issue of Forbes ASAP lauds the value of alliances: “Our statistical analysis shows that companies with more joint ventures, marketing and manufacturing alliances, and other forms of partnerships, have substantially higher market values [than companies that do not form such partnerships].” The key takeaway of the article is that, “In the connected economy, connections matter. Alliances are incredibly, even decisively, important.”

Asbury has taken this advice to heart. Strategic business partners allow the organization to rapidly expand the expertise of the organization without significant capital expenditures. These partners primarily cover ancillary areas that have a direct and important impact on the customer value proposition, including dining, building services, fleet and energy management, rehabilitation services, workplace safety, interior design and architecture, technology, and marketing and branding. Each business partner is an industry leader in his or her respective area with a great depth of expertise and resources specific to the senior living industry. Mike Hollen, president of The Asbury Group, notes, “Just within the last year, partnerships with Sodexo, TripleCare and K4Connect have helped us bring significant innovations to the market that we couldn’t have accomplished on our own. The knowledge and expertise that our group brings to the table when combined with the talents of our strategic partners typically adds an exponential benefit to the service or product. Not only are we expanding Asbury’s business lines, but also we’re improving the lives of seniors every day!”

Another organization that understands the value of growth through partnerships is United Methodist Retirement Communities, Inc. (UMRC). Despite serving older adults for over 110 years, very few senior living organizations have the entrepreneurial spirit that UMRC continues to display. UMRC now offers Michigan’s most diverse housing options and services to seniors of all income levels with a total of eight campuses in 12 counties and serves more than 2,600 older adults in Michigan.“We have to be creative,” says John Thorhauer, UMRC’s president and CEO. “The time to prepare for significant growth is now. Today’s seniors want quality, active lifestyles and choices and UMRC is dedicated to providing this lifestyle through a diverse array of options available to older adults at different income levels.” John continues, “Not everyone will want or can afford the full service retirement community setting.” UMRC’s multiple partnerships in Programs for All-Inclusive Care for the Elderly (PACE) and affordable housing have successfully leveraged the experience of six other senior living housing and service agencies.

John adds “As Michigan’s senior population continues to rapidly expand, nonprofit organizations committed to a mission of senior care must seek to meet an increased demand for services through growth and partnerships. Organizations like us need to leverage our existing strength to attract philanthropy and new capital to even attempt to keep up with demand”.

While Asbury might not be alone in understanding the value of strategic partnerships, it might be one of the most aggressive in pursuing these opportunities. Unlike many other senior living organizations, Asbury had the wisdom to craft a unique team to focus on creating strategic partnerships (rather than throwing this responsibility on top of the executive team’s existing responsibilities).

Service lines

The ability to seek and create new partnerships also gives Asbury the ability to quickly add new service lines. Currently, Asbury’s core competencies include:

| · Executive/Senior Leadership | · Master Campus Planning |

| · Information Technology | · Legal Services |

| · Clinical & Quality Systems | · Risk Management & Compliance |

| · Accounting & Finance | · Sales & Marketing |

| · Budgeting | · Communications |

| · Financial Projections | · Training & Education |

| · Development (Fundraising) |

Some of these core competencies are accomplished with the assistance of trusted partners that Asbury has vetted (full disclosure: Love & Company is one of those partners), while many are handled entirely in-house. All are managed with Asbury’s skilled and experienced oversight. But it’s the new service lines that excite me.

Some of the major initiatives Asbury is studying right now include telehealth, home care, robotics, smart home technology and a group purchasing organization. Interestingly, all of these initiatives could have a key strategic role in supporting another initiative Asbury is considering, CCRCs without walls (also known as Continuing Care At Home or CCaH).

Asbury recently entered into a partnership with TripleCare.

Affiliations

In a thoughtful LeadingAge Magazine article, David Smeltzer had some advice for providers contemplating a new partnership through a merger or affiliation. “A merger can either happen in your control or out of your control. Don’t wait until things get bad to try to find a partner who shares your values,” cautions Smeltzer, president and CEO of Heritage Ministries in Gerry, NY.

“I encourage any retirement community with less than $15 million in operating revenue a year to start seeking out potential merger or affiliation partners,” he adds. “It takes insight and courage for a board to act proactively.”

Asbury’s CEO Doug Leidig agrees. “Across the country, we see lots of great standalone communities that are simply too small and undercapitalized to be able to modernize. Being able to modernize is particularly important when it comes to their IT systems because these systems provide efficiencies that are vital in today’s competitive environment. Insightful, standalone community CEOs and boards are beginning to understand that affiliations provide the managerial support that benefit larger multisite organizations. It’s our job to reward the CEO for his or her foresight and make him or her look good.”

Asbury recognizes that most non-profit Life Plan Communities have highly valued cultures and brand identities in their markets. Therefore, it is Asbury’s philosophy to maintain and build upon the brand identity of each community and, more importantly, the local culture that current and future residents expect. Sandra Hegelein Lawson, Asbury’s Chief Strategic Alliances and Growth Officer, points out, “Asbury believes that everything we do should support the residents and the associates of the communities we work with. Our mission is deeply rooted in John Wesley’s credo to: ‘Do all the good you can, by all the means you can, in all the ways you can, in all the places you can, at all the times you can, to all the people you can, as long as ever you can.’ We aim to assist the CEO however he or she would like. Our core strengths are the ‘back of the house’ business systems such as strategic planning, operations, information technology, marketing and financial management that leverage the expertise of our team and our business partners to the degree desired by the CEO and their team.” Sandra continues, “What’s so rewarding is that we often learn as much from our partners as they learn from us. This synergistic relationship provides efficiencies and access to expertise that neither organization would have access to…all while maintaining individual identity and culture.”

Watch the recording of our “The Reasons for Growth” webinar featuring experts from LeadingAge, HumanGood, and Asbury!

Next up:

The Age of Disruption: Part IV, The Battle for Talent

Previous:

The Age of Disruption: Part II, The Power of Place

The Age of Disruption: Part I, The Wolf at the Door

For more information about how Love & Company can help your community or organization grow smartly, contact Tim Bracken at 410-207-0013, or request a free assessment!