Like the residents they serve, many senior living organizations are change adverse. Years of operational and financial stability, combined with revolving board members and relatively satisfied customers, can promote a “better safe than sorry” mindset.

Like the residents they serve, many senior living organizations are change adverse. Years of operational and financial stability, combined with revolving board members and relatively satisfied customers, can promote a “better safe than sorry” mindset.

However, rising operating costs and challenges in the labor market post-pandemic have resulted in eroding margins in 2022 and 2023. Financial viability is top of mind for nearly every healthcare executive in the country. And while many organizations have endeavored to implement service fee and entrance fee adjustments to cover these additional costs, we still see senior living organizations face difficult decisions driven by margin pressures.

But the path to financial sustainability won’t be achieved exclusively through cost-cutting and modest revenue generation. The more sustained approach is through the exploration of unique strategic paths that will lead to mission-aligned, profitable and sustainable growth. These critical capabilities of financial sustainability and growth fluidity are part of the eight critical elements Forvis Mazars believes are necessary to create a “value-centric enterprise” as highlighted in our article, “Realizing Value: Forvis Mazars’ Healthcare Market Point of View.”

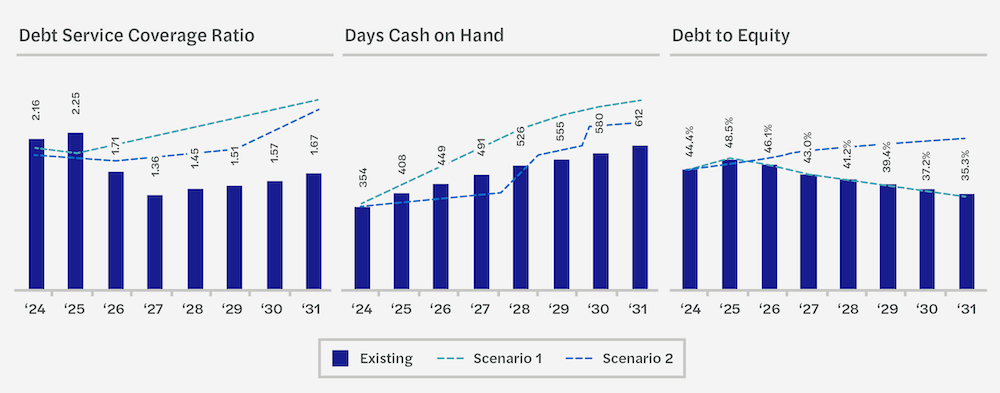

In planning for growth, organizations cannot simply look to demographics and/or design trends to guide the way. An organization must also understand its historic, current and budgeted financial performance as well as current debt covenant compliance metrics, such as debt service coverage ratios, days cash on hand and debt-to-equity ratios.

To truly understand the impact of growth plans, we recommend a three-phased approach to (1) understand current financial performance (Financial Assessment); (2) estimate future financial performance, including what opportunities are available to improve existing operations (Financial Future); and (3) evaluate the financial impact of growth strategies (Financial Impact of Growth).

Financial Assessment

The annual budget process is time-intensive and critical to setting expectations for management, board and other stakeholders of an organization. However, this process often can focus exclusively on current-year occupancies, payor mix, staffing levels, salaries/wages, supplies, insurance, dietary, utilities and other operating expenses. We recommend organizations perform a deeper dive into historical financial results when developing budgets and financial goals, including:

- Monthly utilization for all levels of care

- Operating expense trends, compared to historical and comparable industry benchmarks at departmental and/or service line levels

- Labor management strategies

- Nonlabor cost management such as supplies, purchased services, agency costs, insurance, dietary, employee benefits and utilities

- Operating margin ratio trend analysis

- Actuarial funded status

- Relevant analyses and planning documents performed by management or consultants

Whether your organization is planning for growth or just strengthening your financial position, a robust set of historical and industry metrics will allow for more thoughtful decision-making and areas of focus.

Considerations when beginning a financial assessment:

- Does your organization simply use current-year performance to create annual budgets?

- As your organization begins the budget process, do you have benchmarks and/or goals to guide the process?

Financial Future

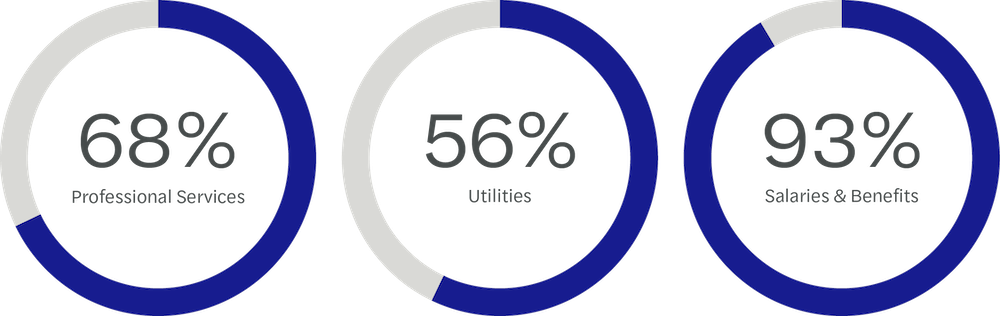

While the worst of the pandemic has subsided and extreme inflation levels have moderated, organizations now find themselves loaded up with significantly higher operating expenses. As described in the Forvis Mazars’ 2023 State of the Nonprofit Sector Report, all nonprofit organizations are struggling with cost increases, with approximately 93% of surveyed organizations absorbing additional employee compensation expenses between 2022 and 2023.

While the industry has made notable efforts to increase resident service fees within the past year, we believe the surging population of prospective residents begs the question, “Have organizations done enough to improve or even maintain future financial performance as they prepare for growth?”

For a better perspective on future financial performance, organizations must look beyond next year’s budget cycle to determine long-term financial standing. We recommend organizations develop a dynamic financial model, reflecting budgeted performance for the next five to 10 years. The proforma should incorporate the results and plans developed for existing operations during the Financial Assessment process to include:

- Assumptions for occupancy/utilization level adjustments

- Assumptions for changes to service fees from private pay and key third-party payors

- Assumptions for changes to estimated operating expenses, including salaries, benefits and other nonsalary operating expenses

- Assumptions for estimated routine and strategic capital expenditures

- Assumptions for projected required covenant ratios to ensure compliance is achieved

As organizations consider growth opportunities, a clear understanding of the expected financial performance of existing operations is vital. Without this knowledge, how can organizations know if future growth plans are better than the current state?

Considerations when planning for your financial future:

- Will increases in your monthly/daily/entrance fees mitigate the impact of higher expenses?

- Will your operating margin increase or decrease in the coming years?

- Will you rely on cash on hand to fund future operations?

Financial Impact of Growth

Based on the findings and assumptions from the first two phases of the process, organizations are now fully prepared to evaluate the financial impact of planned growth strategies. From our experience, organizations often evaluate multiple growth options, along the lines of the following example. Using the financial proforma developed during the process, in coordination with other members of your development team (including architect, marketing, banking and development firms), organizations can determine the impact of growth plans on operations, cash levels and existing covenant requirements.

Considerations when developing a growth strategy:

- How will you determine if your growth strategy is financially beneficial?

- What level of cash/liquidity will you need to develop and implement your growth strategy?

- Is your growth strategy too expensive?

Final Thoughts

Ready or not, the senior living field is changing. As providers continue to operate in an environment with increasing consolidation, competition, regulatory and wage pressures; changes in care delivery, consumer preferences and staff expectations; and decreases in nursing length of stay and operating margins, it’s critical for management teams to evaluate long-term financial performance expectations and determine their organization’s ability to pursue growth initiatives.

This article is for general information purposes only and is not to be considered as legal advice. This information was written by qualified, experienced professionals at Forvis Mazars, but applying this information to your particular situation requires careful consideration of your organization’s specific facts and circumstances. Consult a professional at Forvis Mazars or legal counsel before acting on any matter covered in this update.