Guest article by Stephen Johnson, Managing Director, Senior Living Finance, Ziegler

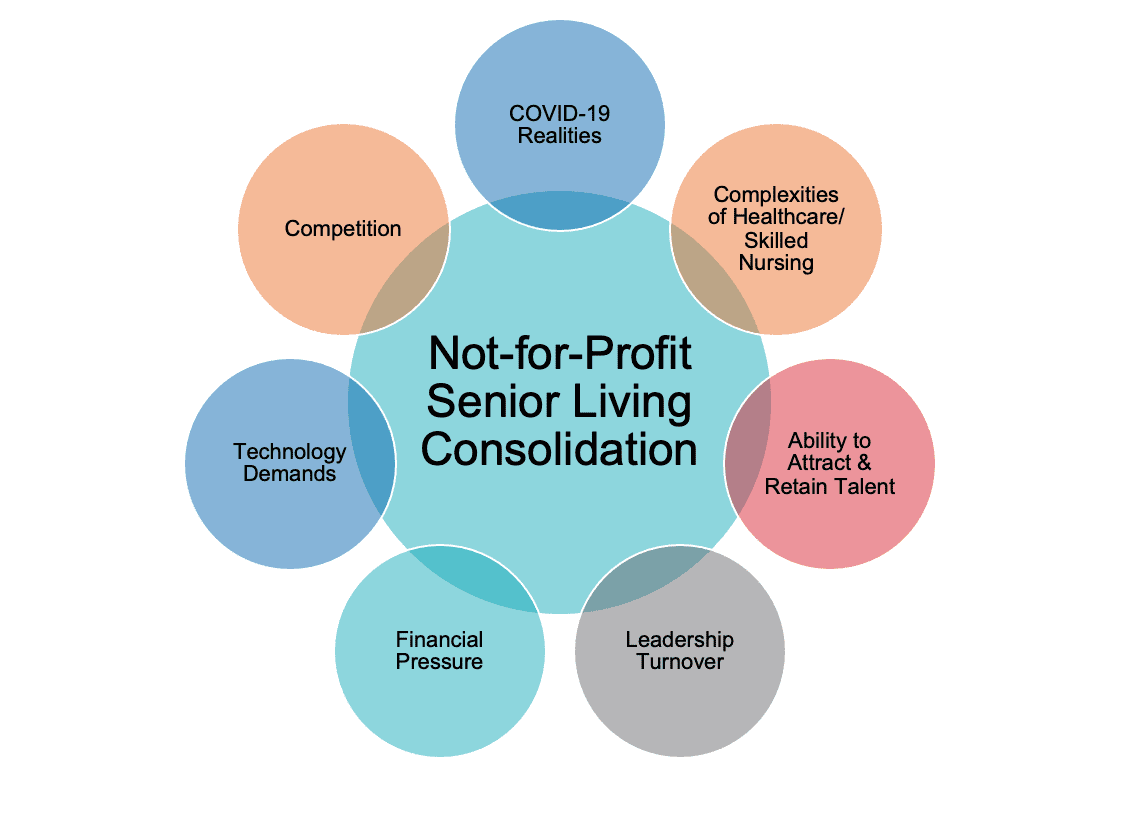

We know that across the past decade, more than 900 not-for-profit senior living communities have changed hands. This includes not-for-profit senior living mergers, acquisitions and dispositions as well as closures that have occurred. We have observed this consolidation trend in numerous other healthcare sectors, notably the hospital world. There are very few freestanding community hospitals today compared to twenty, or even ten, years ago. The COVID-19 pandemic has accelerated the rate of sponsorship transitions. The graphic below highlights the top drivers for the not-for-profit senior living consolidation.

We know that across the past decade, more than 900 not-for-profit senior living communities have changed hands. This includes not-for-profit senior living mergers, acquisitions and dispositions as well as closures that have occurred. We have observed this consolidation trend in numerous other healthcare sectors, notably the hospital world. There are very few freestanding community hospitals today compared to twenty, or even ten, years ago. The COVID-19 pandemic has accelerated the rate of sponsorship transitions. The graphic below highlights the top drivers for the not-for-profit senior living consolidation.

Ziegler often gets asked the question, “How big is big enough?” The answer to this question is not a simple one and often comes down to sophistication, overall revenue and the ability to be competitive in your local market(s). Bigger is not always better. Particularly with increasing size, decisions may take longer, communication can be slower, and there have been examples of mega-organizations with a large national footprint that have struggled. However, given the growing complexity of the sector and the sponsorship transition drivers that were previously outlined, the larger you are and the greater your sophistication, the more likely you will be able to sustain yourself in the long-term. Many providers have come to appreciate that benefit of scale throughout the past year of the pandemic.

At the same time, some provider organizations have reached the point of assessing whether they are positioned to be the affiliator or the affiliatee. This generally relates to control. Are you, the provider, willing to become a part of another organization through a transfer of sponsorship, or are you only interested in growth, whereby you are the primary sponsor and other organizations fold into yours? It is noteworthy to acknowledge that when you are in a position of financial and operational weakness, you may not have a choice in this regard. For those who are looking to grow by having others affiliate with their organization, it is important to take a proactive stance and actively seek engagement opportunities. Taking a passive, opportunistic approach may lead to lost opportunities in this fast-moving environment.

Do Not Wait Too Long

It cannot be emphasized enough that if provider organizations are experiencing early, or even advanced, signs of distress, it is important for them to reach out to explore options. One of the reasons that more than half of the not-for-profit sponsorship transitions since 2010 have gone to private sector buyers is because the communities were in too much financial distress for a not-for-profit organization to step in as the new sponsor. Ziegler has created a checklist tool that may be helpful for boards and leadership teams to use. The purpose of this checklist is to give not-for-profit senior living and care providers the tools necessary to make informed decisions regarding the future of their organizations. In many instances, the items below can be “red flags” for organizations and can serve as a catalyst for making a meaningful change. The items listed below are a sample of questions from the checklist.

- There is new competition in the area and the organization is having difficulty being the top one or two leaders in the primary market area.

- Occupancy has dropped and is not showing signs of significant improvement.

- The organization has had significant operating losses for the last two or more years and limited financial reserves to cover these losses.

- Your organization needs money for other initiatives, such as supporting another related organization or developing a new service.

- The organization struggles to provide a competitive wage compared to others in the area.

- There are concerns about the ability to fulfill payment of debt obligations.

- There have been no meaningful physical upgrades to the community in the last 20 years.

- The organization does not have the resources needed to bring the aging physical plant up to par for current and future residents.

- The board and leadership team have not engaged in a strategic planning process in recent years.

- Turnover is high and there is difficulty retaining talented people.

Concluding Thoughts

It is important to note that every affiliation, merger, acquisition, disposition and closure is a unique story. Similarly, the conversation about whether to formally join with another organization is a personal one, unique to your organization. It is important, however, for organizations to be prepared and for boards to have the conversation. This puts organizations in a much stronger position if growth opportunities present themselves in the future, or if the organization needs to make a decision to partner with another for long-term sustainability.

––

Disclaimer Statement: Information contained or referenced in this document is for informational purposes only and is not intended to be a solicitation of any security or services. B.C. Ziegler and Company | Member SIPC & FINRA

—

For more articles from guest contributors and senior living thought leaders on the Love & Company blog, click here.