Guest article by Toby Shea, Partner, OnePoint Partners

Just as they have in many other facets of their lives, younger members of the silent generation and older boomers want to do things differently in senior living. While the entrance-fee model has been the long-held standard in not-for-profit senior living, more and more seniors are preferring the flexibility and freedom found in rental products.

People older than 55 are the fastest-growing segment of the country’s rental population. This demographic shift—a 28 percent increase in renters older than 55 between 2009 and 2015—represents 2.5 million seniors.

This shift is something that the not-for-profit senior living field needs to prepare for, as it represents a significant proportion of future demand. While the entrance-fee model remains strong, and is by no means obsolete, many organizations are expanding the reach of their missions by rolling out rental products, some with great success, to reach a broader audience. It is therefore important to understand the trends and consider their implications on our communities.

Seniors are attracted to rental communities for two primary reasons.

1) Affordability

Affordability and flexibility go hand-in-hand and represent important considerations for why many are preferring rentals over entrance-fee communities. For boomers in particular, projections show that a significant proportion do not have strong asset bases. For many, their home will be their major asset, and locking up that asset in an entrance fee is not a realistic use of those funds.

Rental communities, on the other hand, allow boomers to keep their assets liquid. This provides them with more control over their financial futures. The flexibility to leave the rental community, without losing all or part of their entrance fee, is attractive and even worth paying a little more on a monthly basis.

2) Freedom

Seniors are also attracted to rental options for the freedom, which is realized in many ways. As with most Life Plan Communities, rental communities eliminate home maintenance. An in-town, walkable community allows residents to feel more connected to the city center or neighborhood, with more freedom of choice with their newfound time. For some, it is more of a psychological freedom that comes from removing the perceived restrictions and long-term commitments that come with an entrance-fee contract.

In addition, many of today’s seniors long to enjoy what comes with city apartment living, which is largely rental: a low-maintenance lifestyle that allows them to be part of an active community. They are not as interested in an isolated, independent living “campus.” Boomers are seeking places where they can still have easy access to grocery shopping, restaurants, walking trails, fitness centers, music venues and theaters. As this generation gears up to enter its rightsizing years, Life Plan Communities will need to prepare to meet the desire for this lifestyle, especially when considering expansions and partnerships.

Should your entrance fee organization introduce a rental product? And does it require a separate site/campus, or can a rental model be successfully integrated into an existing entrance-fee community campus?

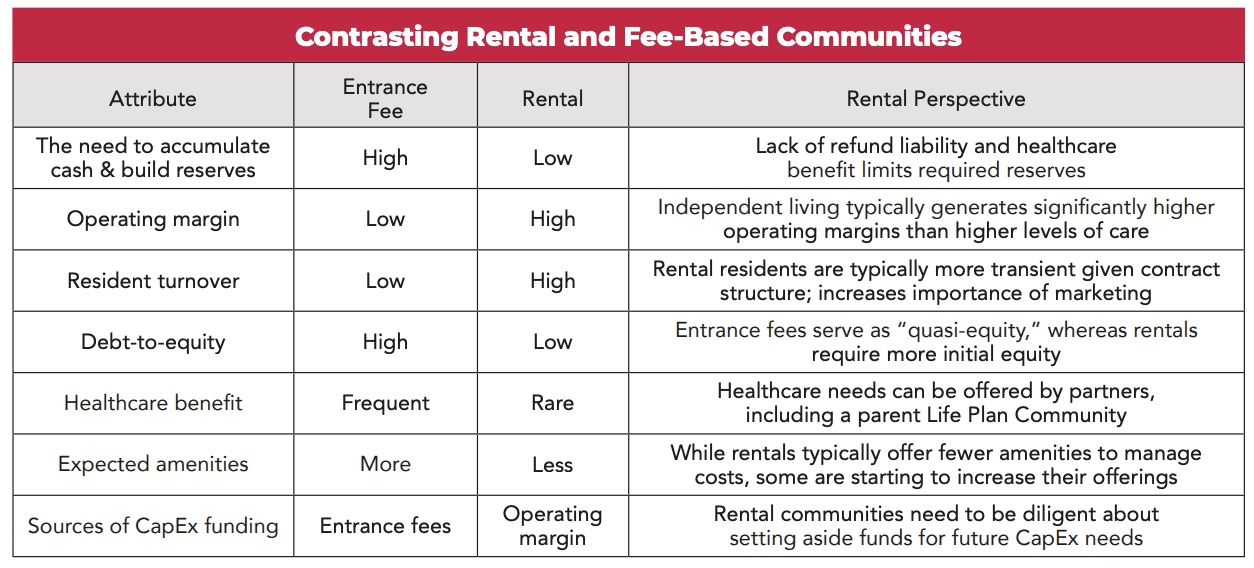

There are several key operational and structural differences between entrance fee and rental communities. The chart below provides an overview of the contrasts.

If your organization wants to take advantage of the increased consideration of rentals, or if the market in which you operate dictates consideration of a rental option, two main approaches tend to work for existing providers.

- The first approach is to convert some or all of your existing entrance-fee product into rental. This requires two key ingredients: capital and time. This approach is difficult and requires much advanced planning as the refund obligation of existing entrance fees combined with lost entrance fees from turnover proceeds pose a major funding challenge when trying to harness those two key ingredients.

- The second approach is to develop a new rental product. In many ways, this can be easier to accomplish than a conversion from entrance fee to rental. Furthermore, organizational leadership may view the addition of a new rental product more optimistically, and as an intentional, strategic initiative to diversify product offerings and serve a broader consumer market, while converting entrance-fee residences to rentals is sometimes perceived as an attempt to fix an existing market challenge.

Regardless of the approach, additional recommendations for success include:

- Start with a deep understanding of your market and the potential influence of rental offerings on your specific community. Adding a rental offering—either through conversion of existing or development of new—is not a strategy in and of itself. Are rental competitors impacting your occupancy? Is there opportunity in the market to add a rental product? Understanding your market and positioning of your community is the first place to start.

- Do not wait too long to start, and do this from a position of strength and strong performance. Conversion to rental becomes exponentially more difficult if your community is already struggling with occupancy. Similarly, if the market opportunity exists to develop new rental product, waiting to act can invite competition and the opportunity could be lost.

- Have a focused master plan with a distinct direction based on your organization’s chosen approach to adding rental, and an understanding of how adding rental product to your campus fits within the overall vision and plan.

- Focus on the operating plan. Since rents will be the sole source of cash flow, it is important that the services and amenities are consistent with your future cash flow.

- Have a sound understanding of the potential financial implications of adding rental—particularly if it is replacing entry fee product—and the impact on cash flow moving forward. Also ensure you have a capital strategy in place to adequately support the needs of this effort.

As the rise of rental continues, our field must recognize that rentals present a different opportunity, while the entrance-fee model remains a viable option. The ultimate direction your community should take will depend on your market’s unique conditions and on how your leadership team determines you can best be positioned for future success.

—

For more articles covering senior housing trends and how providers must adapt to them to continue fulfilling their missions, click here. To download Love & Company’s brand-new white paper, “Senior Housing Trends: 2021,” click here.