By Tom Mann, Principal, Executive Vice President

If you are a regular reader of The Leaders’ Board, you’ve had the opportunity to read predictions of some of the brightest minds in senior living. Now, it’s my turn.

Last year, I wrote a well-received white paper titled Senior Housing Trends, which covered key senior living trends on demographics, prospect expectations, technology, transportation, nanotechnology and more. Interestingly, all of the trends I wrote about have and continue to play out as I predicted, which can only mean one thing: I played it too safe.

This year, I plan on stepping out a little further on the branch with six bold predictions.

1.) Offering truly varied food options will become the number one driver of success for early adopter retirement communities.

“You say you want a revolution!” More than two and a half million boomers (including Paul McCartney, Bill Clinton, Al Gore, and Martina Navratilova) now identify as vegetarians, and that number is rapidly growing thanks to the Boomer generation’s desire to ward off chronic conditions and consume in an environmentally responsible way.

According to Northwest Earth Institute, “the word “vegan” has steadily increased in Google searches—it is now up to 36 million hits. Chipotle offers vegan burritos. Even White Castle is testing veggie sliders in selected markets. And Kaiser Permanente, the country’s largest HMO, recommends that its members eat a plant-based diet. The vegan trend has also impacted the dairy industry. Cow milk consumption is down, while the sales of soy, almond, and other milk substitutes are up.” One book that will increase this trend within the senior living space is Dr. Valter Longo’s The Longevity Diet, which studies the dietary habits of centenarians around the globe in Blue Zones.

While vegetarians are far from the majority, the push for a more plant-based, organic, farm-to-table approach to dining is becoming mainstream. Communities that don’t offer a varied approach to food options will quickly be reduced to eating their competitors’ leftovers. Educated consumers are now asking where and how their food is sourced.

Forward-looking communities like Garden Spot Village have introduced innovative ways to supply their own vegetables and fruits through the use of an aeroponic greenhouse. Whether you are sourcing the food yourself, like Garden Spot, or purchasing through local vendors, varied food choices are no longer optional. Put another way, David Koelling of Strategic Dining Services says, “Ability to adapt is the key to the modern kitchen…either taking advantage of seasonal opportunities and regional sourcing or adapting to the ever-changing expectations of our residents and potential residents. The focus has to be on building a team that is not only capable of adapting but has the resources, training and the support of leadership to do so.”

2.) Retirement communities will work harder to attract younger singles.

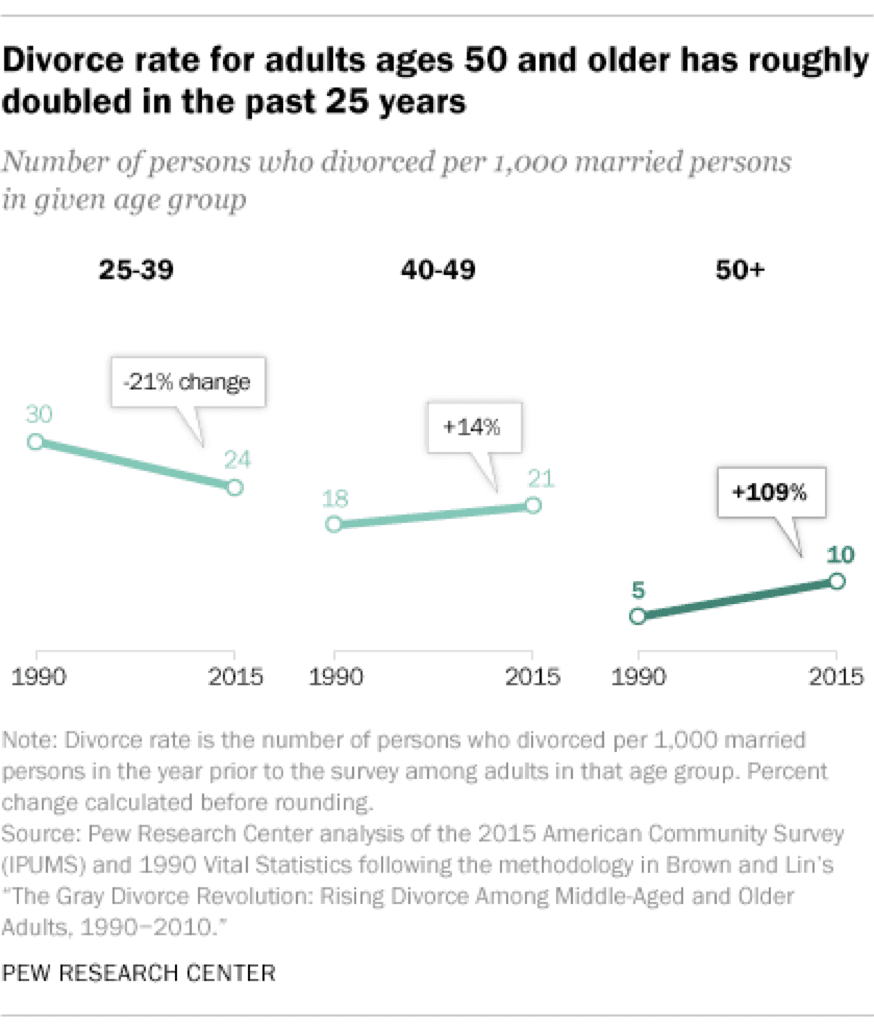

While divorce is currently on the decline for younger couples, divorce among Americans 50+ has more than doubled since the 1990s. This trend called “Gray Divorce” will shape how senior living communities think about floor plan sizes, service options and social opportunities on and off-site.

While these sheer numbers might look relatively low in comparison to other age groups, the jump in percentages is startling. In addition, the boomers divorced at a higher rate than previous generations and many of them never remarried. The composition of senior households has shifted dramatically over the past two decades as more seniors are living alone. While only 29.5% of senior households age 65 and older were living alone in 2000[1], this had increased 43.2% in 2016[2].

Several factors that likely contribute to this increase are higher divorce rates, an increase in the percentage of people who have never been married and an increase in widows/widowers.

3.) Total transparency will reach into every corner of senior living and healthcare.

CEOs need look no further than United Airlines to see how social media changes everything. Smart senior living organizations will accept the new norm that there are no secrets. Thanks to the far-reaching tentacles of Facebook, Twitter, Yelp, LinkedIn, Instagram, Google reviews, etc., prospects can now easily peek beyond the gates of your community. They can see the residents, the staff, your organization’s processes, pricing and values. While they might not have the whole story, they are catching glimpses of your organization.

Social media enables those that have been wronged (or feel they have been wronged) to voice their displeasure, and allows unhappy customers and staff to unite together, thus magnifying their voice. All of which means that your internal culture is becoming the most important part of your brand. Online reviews will become a key driver of your business.

4.) Seniors will choose to stay employed … both for money and engagement.

Two of my favorite books, Blue Zones and The Purpose Economy, talk about the importance of having meaningful, daily engagement. For many people, that connection and purpose comes from vocational activities (whether they be paid or volunteer).

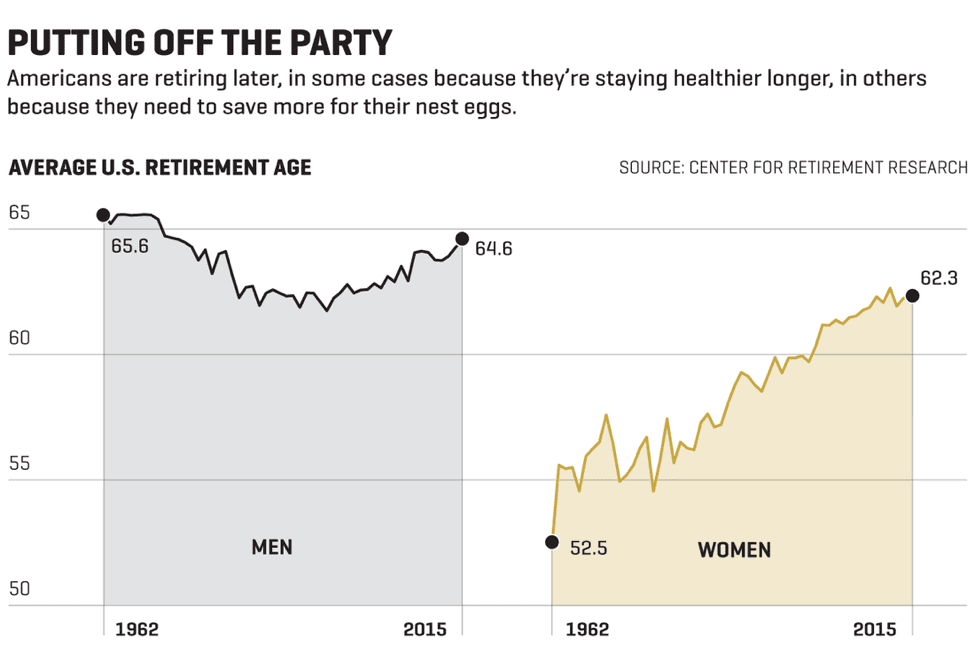

In addition, as seniors live longer, they are seeing the need for increased saving. This is particularly true for the upper-middle class, the demographic that typically moves into retirement communities.

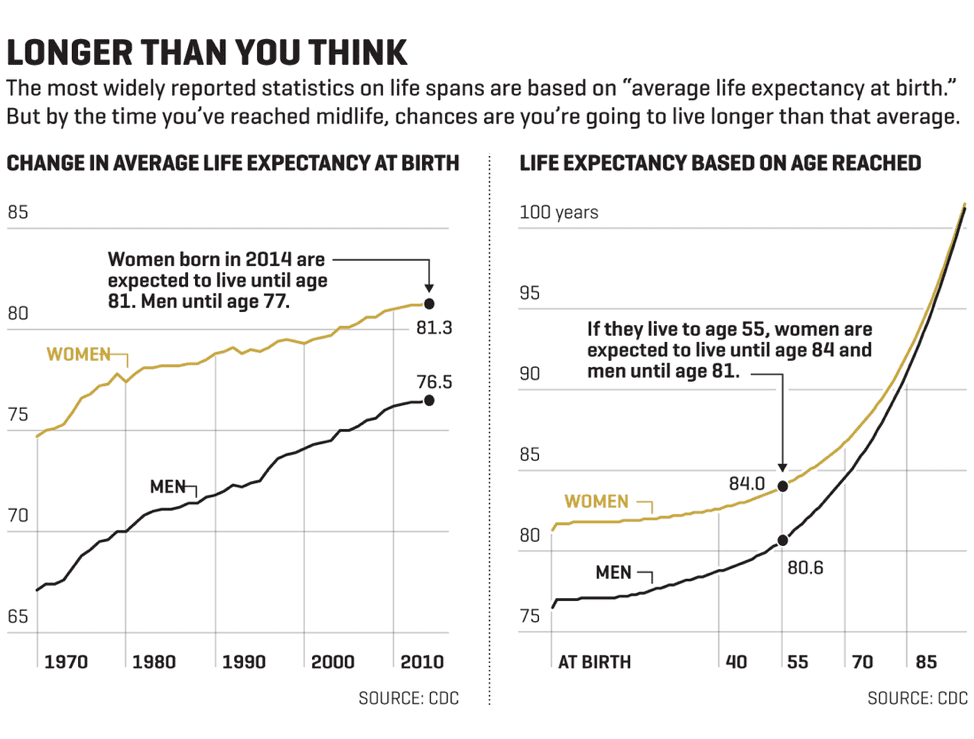

The most frequently quoted stats about life expectancy (American men born today can expect to live to 76.5 years, and women 81.3) are misleading. For those of us in our fifties, we have already outlasted those who have passed away (they skewed the average downward). Thus, we “survivors” can expect to live much, much longer than the average expectancy. This is particularly true for the upper middle-class that have access to quality healthcare and healthcare information. Take a look at the CDC chart below, along with this article in Fortune magazine to get a sense of the implications.

So, what are the implications of lifetime employment to your Life Plan Community?

- We are going to have to modify how we financially qualify people, taking into account current income potential.

- On-site co-working spaces that allow residents and non-residents of multiple disciplines to share office space and ideas will become the norm for progressive communities looking to attract younger, more vital people. For an excellent article on this topic, check out the Harvard Business Review.

- The concept of Live Where You Work, Eat, Play will become a competitive advantage for communities that truly understand the power of this positioning.

- You will need to drop the term “retirement” community from your community’s descriptor.

5.) Residents will be active participants in their wellness as opposed to patients.

Boomers want to take care of themselves (spiritually, physically, intellectually, emotionally, and financially) rather than be taken care of. The communities that grasp this paradigm shift are the ones that will separate themselves. While many communities say they want to provide this environment, few have succeeded (less than 1%). The first sign that you have succeeded is when your community’s average move-in age is in the mid-60’s to early 70’s.

How do communities get there?

- Communities will model their wellness programs after Canyon Ranch. As a benefit of living at the community, residents will receive a complete “executive” fitness exam like those given at the Cleveland Clinic. The community’s medical, fitness and dining services team will be a well-coordinated part of each resident’s wellness team.

- The Quantified Self digital trend will continue to gain traction with boomers. These digital interventions (perhaps every resident receives an Apple Watch or Gear S2 smartwatch as part of their move-in package) will create positive inventions. We’ll see everything from fitness to sleep, to glucose monitoring, ideally improving wellness and empowering residents to be the champions of their own health. Residents will be enabled to attack and manage health issues that are either chronic or acute. I predict that insurers such as Kaiser Permanente and Humana, that are already studying digital health interventions, will soon partner with progressive communities to improve success rates for resident treatments and lowering readmissions.In addition, all of this personal healthcare information now being collected will be compared with larger data sets of people with similar medical backgrounds (both genetic similarities and medical history) in new ways to improve treatments.

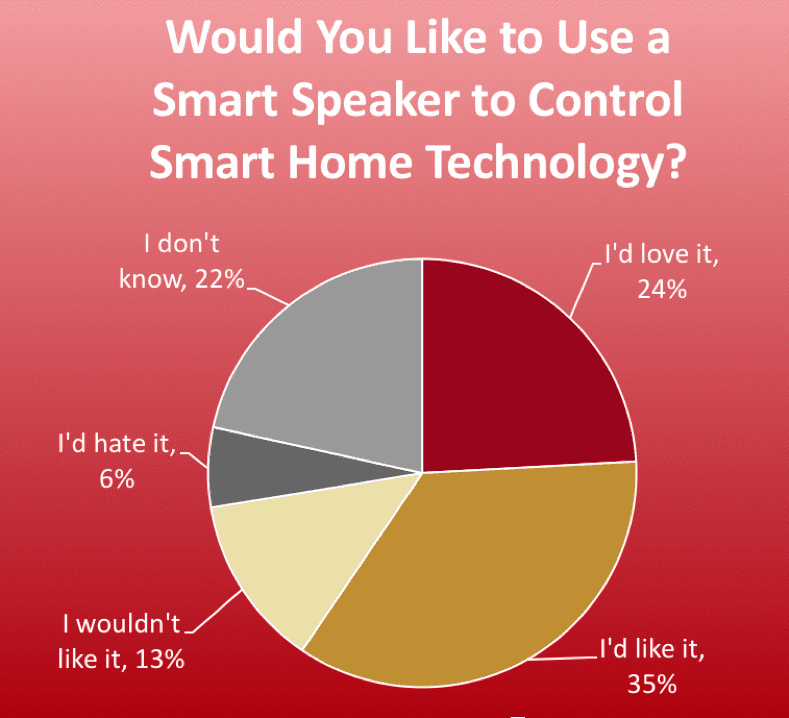

- Residents will become more aware of on-site and off-site activities (and thus, more engaged) as smart speaker technology like K4Connects becomes the norm due to ease of use. With one of the fastest adaptation rates of any technology in history, smart speakers will soon be ever present in retirement communities. In 2016 there were less than 10 million smart speaker users. By 2019, it is projected that there will be nearly 60 million! Love & Company recently did a study for Michigan State University, a potential sponsor of a University Retirement Community (URC™), with age and income qualified seniors and found that a whopping 59% of the seniors interviewed would “like” or “love” the opportunity to use a smart speaker.

6.) Communities will continue to reduce the number of available long-term care beds.

As in-home and on-site therapy treatments continue to improve, communities will continue to service residents as long as possible in their apartments and cottages.

As Eric Krull, Executive Vice President of THW Design states, “We all have seen both senior living communities and hospitals decreasing the number of available long-term care beds. The question they are asking is how do we shift our positioning and what do we do with the skilled beds that are so costly to operate? With the cost continuing to rise to maintain skilled nursing units, we have continued to reposition and transform LTC wings/buildings into Transitional Care Units used for short-term rehabilitation and therapy services with “Smart Gym Technologies.” This helps the provider find new avenues of income. In the past year, we completed the master plan for a large heath system that has expanded this concept to include housing and “Light Surgical Procedures” to serve a rural community. This new concept integrates LTC beds, post-acute beds, memory care, psychiatric care, urgent care and MOB service needs to a whole new level under one roof. Imagine creating “Concierge Care” in a “Life Style Village” in less than 100,000 square feet, in a one-story building shaped and formed in a residential hospitality ambience, with a focus on healing and resident-centered care. All of this integrated into a senior housing campus with IL and AL serving not just the internal community but the greater community … perhaps this will redefine what our Life Plan Communities will be in the future.”

I hope you have enjoyed our series on senior living trends. I’d be interested in your thoughts and ideas.

Footnotes:

[1] According to the 2000 census, 29.5% of senior households age 65 and older who were not living in group quarters were living alone.

[2] According to the 2016 American Community Survey, 43.2% of senior households age 65 and older who were not living in group quarters were living alone.

For more 2018 predictions, visit our guest blogs!

‘BB&T Capital Markets’ Predictions for 2018’ by Roger E. Randall, II, Senior Vice President

‘2018 Predictions from Continuing Care Actuaries’ by Brad Paulis, A.S.A., F.C.A., M.A.A.A., Partner