Competitive positioning is how a senior living community differentiates itself from the competition in the market. Beyond knowing your niche, effective positioning requires understanding each of the “value” differences between competing offerings. Once analyzed, such insights can help support communities at various stages of their lifecycle. Whether master planning for the future, rebuilding census, updating pricing or conducting market research, evaluating positioning will help ensure that product and programming align with organizational goals and market expectations.

Before delving into how you can use positioning insights to enhance your community (and your revenue!), let’s first look at how we analyze a community’s position in the market. We do this with our positioning scorecard and standard 10-point rating scales.

COMPETITIVE POSITIONING SCORECARDS

Love & Company’s proprietary positioning scorecards, designed to maintain consistency and assure inter-rater reliability, use a clearly defined, objective rating system to rate each community on the key attributes that most commonly impact a prospect’s evaluation of community choices. We rate 24 different attributes from the perspective of how a prospective resident would see the community. Each attribute has detailed scoring criteria for what earns a score of one, five or 10, with 10 being considered elite for the senior living field. This analysis establishes the vital “value” differences between the community and the competitors.

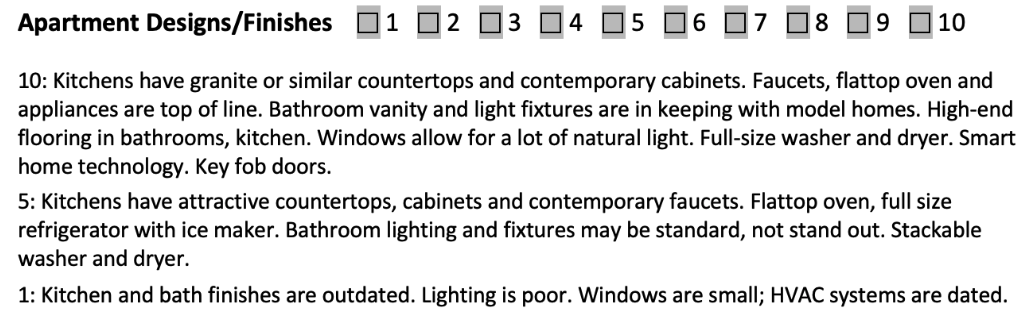

Example scoring criteria for “apartment design/finishes” is shown below.

Now let’s explore four scenarios where competitive positioning scorecards could inform and advance your community’s initiatives.

MASTER PLANNING

When developing long-range plans for a community, one of the main objectives is to align strategic goals with stakeholder needs, market expectations and the physical characteristics of a building or site. Evaluating competitive positioning supports this process by highlighting crucial value differences such as programming gaps, product shortcomings, and other areas where change is needed to maintain (or improve) a community’s competitive foothold in the market. These insights are indispensable when developing future unit size/mix, amenities and programming recommendations for communities in master planning.

At times, we identify areas in which community offerings exceed market expectations. We determine if the differentiator presents a competitive advantage or disadvantage, and for the latter, we present opportunities to modify an offering with minimal competitive impact.

MARKET ANALYSIS

When evaluating opportunities for growth in your market, it’s important to know more than just the number of age- and income-qualified prospects. You also need to know how your community fits into that market, and how your current positioning aligns with potential market demand.

At Love & Company, all our market studies that include site visits now also include positioning scorecards. We use the positioning scores to add context and depth to the competitive analysis in the market study. For example, in addition to comparing independent living (IL) residence types and sizes, the positioning scores for “apartment design/finishes,” “cottage design/finishes” and “IL offerings” reveal differences in product quality and appeal. This more holistic competitive analysis is particularly helpful when estimating demand in highly competitive markets.

Integrating positioning analysis during the market research phase enables more deliberate, strategic decisions early in the project lifecycle. This, in turn, helps ensure that plans are aligned with market expectations and will strongly position the project against the competition.

LOW OCCUPANCY / REBUILDING CENSUS

With national senior living occupancy still below pre-pandemic levels, communities nationwide are working to rebuild census. It is common for struggling communities to review sales and marketing tactics and key performance indicators for clues to help course correct, but this only considers part of the picture. Census-challenged communities benefit from looking not only at sales tactics but also at the quality of their product and programming and how these impact the community’s overall value in the eyes of prospects.

When Love & Company supports communities facing occupancy challenges, our positioning scorecards identify where product and programming are out of alignment with the market and negatively impact the community’s overall competitive position… and by extension, occupancy. We then develop recommendations for specific enhancements to better position the community within its current competitive environment.

The national inventory of independent living increased by 1.9% (6,490 units) in the last 12 months ending February of 2023.1 With growth expected to continue, communities facing occupancy challenges must consider not only how they stack up against existing competition; but how their position may change when new inventory enters the market.

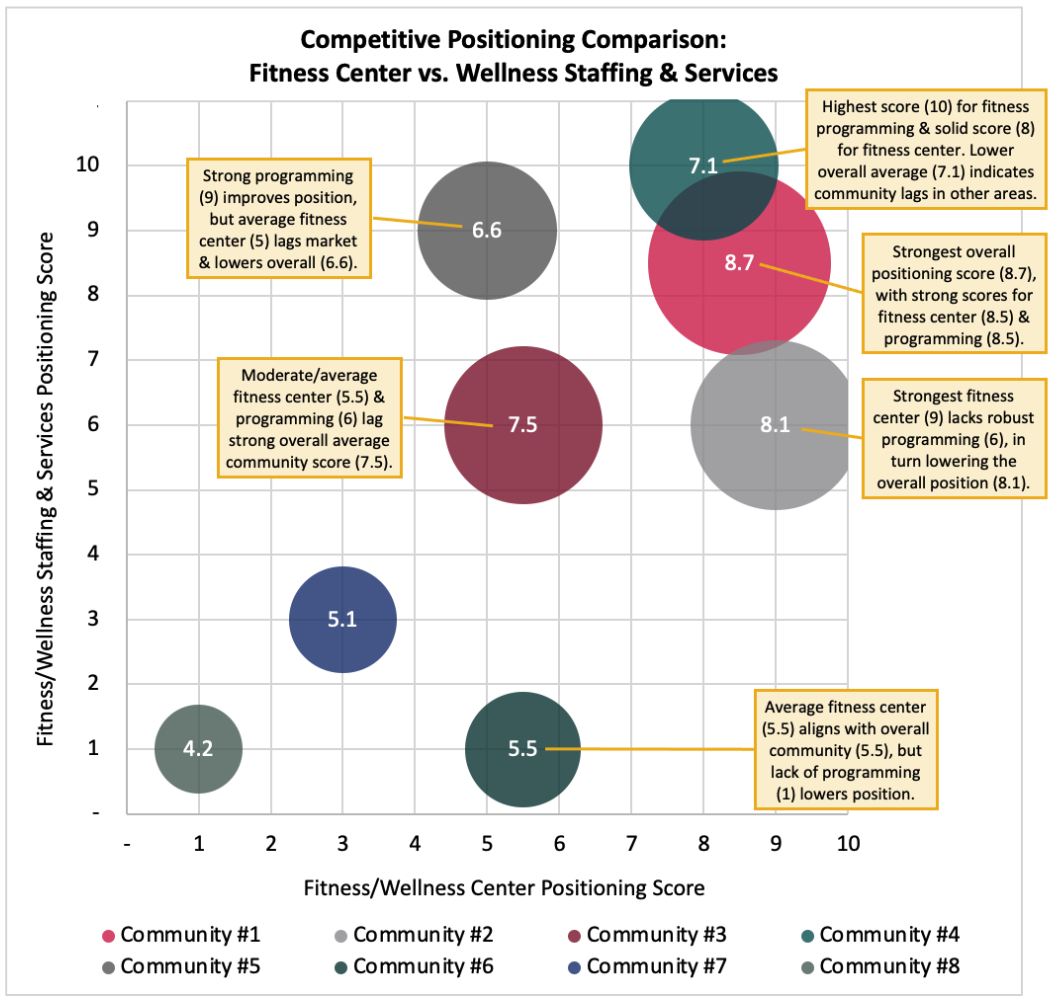

The following graph demonstrates the competitive positioning of eight senior living communities based on their individual attribute scores for “fitness/wellness center” and “fitness/wellness staffing and services.” Each bubble represents a single community, and the size of each corresponds to the community’s overall average score for all 24 attributes.

UPDATING PRICING / ANNUAL PRICING INCREASE

Inflationary pressure resulted in historic annual increases to monthly fees at communities nationwide, with some percentage increases in the double digits. If you are unsure where you can go with your pricing, a competitive positioning analysis can help align your community’s value with its pricing while providing a defensible rationale based on our objective analysis of community attributes.

Often completed in conjunction with a competitive pricing analysis, positioning insights on comparative quality and programming are vital to shaping and substantiating our pricing recommendations. There have been many instances in which we have been able to successfully increase a community’s pricing based on its positioning and pricing analyses.

NEXT STEPS

While positioning analysis has proven valuable in the scenarios above, competitive positioning is an ongoing process. Ultimately, effective competitive positioning is about ensuring that product, pricing and programming align with one another, the expectations of the market, and your vision for the community.

If you would like to discuss these scenarios and how Love & Company uses competitive positioning analyses to support communities in more detail, please reach out to Lauren Houlik, Sara Montalto or Tim Bracken.