Why Life Plan Community Entrance Fees Are Falling Behind

For the past decade, many Life Plan Communities have prided themselves on financial stability and affordability—especially when it comes to managing entrance fees. Although this approach has helped maintain consumer trust and accessibility, it’s also created a growing financial imbalance that could threaten long-term sustainability and hinder future growth.

For the past decade, many Life Plan Communities have prided themselves on financial stability and affordability—especially when it comes to managing entrance fees. Although this approach has helped maintain consumer trust and accessibility, it’s also created a growing financial imbalance that could threaten long-term sustainability and hinder future growth.

Let’s start with the basics. Since 2016:

- Consumer Price Index has risen ~ 33%

- Social Security COLA is up ~31%

- Life Plan Communities increased monthly service fees ~44% to manage operating expenses

From that perspective, it appears that Life Plan Communities are keeping pace with economic trends.

But there’s a different story playing out in two critical areas: home resale values and construction costs.

During this same time frame (since 2016):

- The U.S. median home price index surged by an astounding 97%

- Construction costs (Weitz ILU Construction Price Index) increased by ~ 83%, including a 55% increase since 2021 alone

Yet communities have only increased entrance fees by about 32% during the past nine years.

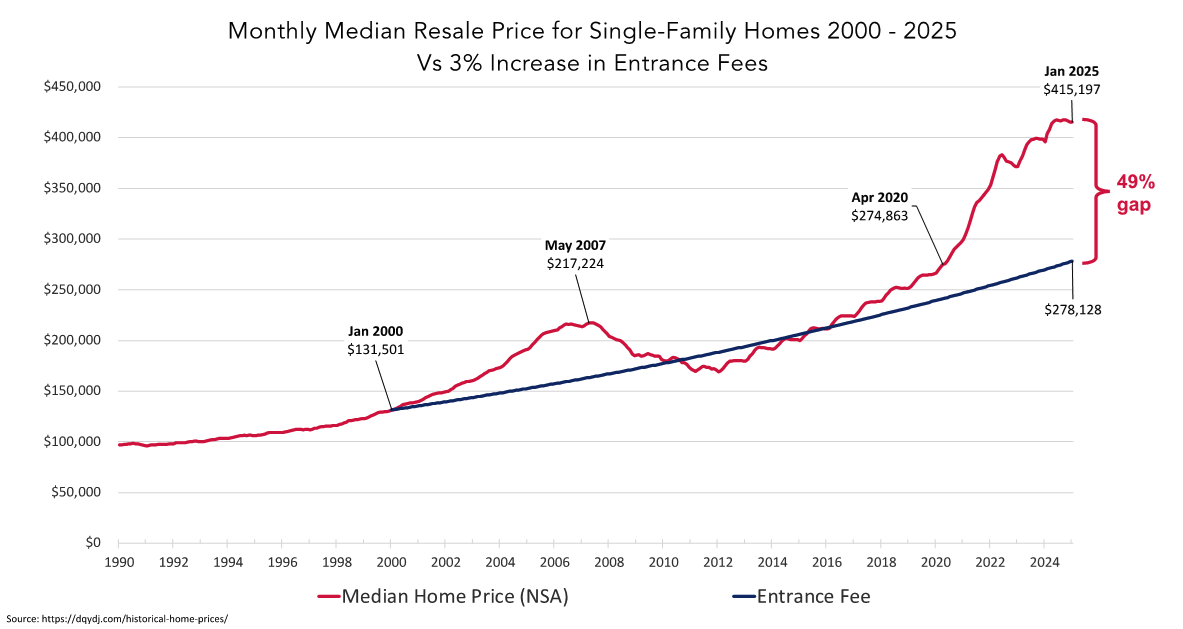

If a Life Plan Community started in 2000 with entrance fees aligned with local home resale values (about $131,500) and then increased those fees by 3% annually—a typical rate—the community would now face a nearly 50% gap between its weighted average entrance fees and the median home resale value in its market.

Why This Matters: Two Core Issues

This disparity causes two major problems:

- Pricing inconsistencies confuse prospects: When it’s time to grow, Life Plan Communities must price new residences significantly higher than existing ones. This price differential can be confusing to prospective residents and may undermine the perceived value of new construction.;

- Shrinking margins on resales: Communities are forced to spend more to renovate older residences for resale, often without being able to recapture those costs.

The conclusion is clear: Entrance fees have not kept up with market conditions. To maintain financial health and support growth, communities must reconsider their pricing strategies—starting with more significant annual entrance fee increases.

Tommy and Rob discussed this topic in much more depth in our May 2025 webinar, “Your Entrance Fees Are WAY Low. Here’s How to Fix That.”

What To Do About It

The first step to correcting this imbalance is gathering the right data through a comprehensive competitive pricing and positioning study. This process should include:

- Home resale value comparison in your market relative to your current entrance fees.

- Competitive pricing analysis to understand how the lifetime cost of living at your community compares to others in your region.

- Competitive positioning analysis to assess how your offerings measure up. Love & Company uses a scoring system that evaluates more than 25 factors to provide a competitive positioning score.

- Reviewing pricing and positioning results together to fully understand your community’s value proposition in the eyes of consumers.

Once this analysis is complete, you’ll have a data-driven foundation to support increases to your entrance fees—and the confidence to act decisively.

Real-World Example: Closing the Pricing Gap

Let’s look at one real-world example of how this process works in practice.

The Situation

A well-regarded community more than 40 years old in a major metro area faced a common challenge. While it had a strong reputation, much of its campus was outdated. A 12-year-old independent living expansion had modern residences that met current expectations, but the original buildings had small residences and structural limitations.

The market opportunity for growth was strong, and the client was ready to move forward with a master plan for a significant expansion. But they had several key questions:

- How much could current entrance fees be increased without harming demand?

- How should the new expansion residences be priced?

- How could they ensure the right price relationship between new and existing homes?

The Approach

Love & Company conducted a full pricing and positioning analysis. Key findings included:

- Median home resale value in the market: $1,216,000

- Weighted average entrance fee (newer residences):

- Declining balance contract: $599,000 (only 49% of median home resale value)

- 90% refundable contract: $922,000 (only 76% of median home resale value)

Positioning Scorecard Results:

- Competitor 1: 7.7

- Competitor 2: 7.7

- Competitor 3: 7.2

- Competitor 4: 7.1

- Client Community: 6.6

The client’s community was solid, but the weakest among its competitive set. However, its lifetime cost of living was significantly lower than most competitors—as much as 30% to 55% lower than some communities, which is an untapped strength.

The Plan

Based on the findings, we recommended a series of entrance fee increases beyond the standard annual adjustment to be phased in over four years. These increases were strategically applied, with more desirable units receiving larger increases.

The Result

Over four years, the price gap between the new expansion residences and older existing units dropped from 40% to 12%. The expansion was now appropriately priced relative to the rest of the community and remained highly competitive in the local market.

Why Aren’t More Communities Addressing This?

Despite the clear evidence, most communities are still holding back. According to Ziegler’s 2024 national survey of community CFOs, the average planned entrance fee increase for 2025 was just 4.6%, down from 5% in 2024. That’s not enough.

Why the hesitation? We hear a few common concerns.

- “We can’t increase rates more than our competitors.”

This is an industry-wide issue. If one community acts, others will likely follow. And even if they don’t, the difference probably won’t be large enough to deter a potential resident—especially if your brand and value proposition are strong. - “We’ve hit a ceiling—going above a certain level makes us look elitist.”

This concern often comes from boards focused on affordability. But failing to respond to market realities harms your organization’s financial health. Boards need to understand the long-term risks of maintaining artificially low prices. - “Some of our residences are hard to sell. How can we justify increasing fees?”

Not all residences need the same increase. Focus the biggest increases on the most desirable homes. Use a tiered approach that reflects each residence’s appeal and market position.

The longer you delay, the further you fall behind. A thoughtful pricing strategy isn’t about charging more—it’s about aligning your fees with value and ensuring your community’s ability to reinvest and grow.

Time to Take Action

If you haven’t re-evaluated your pricing strategy recently, now is the time. Waiting only makes the gap harder to close—and the financial impact deeper. A smart data-driven approach can position your community for long-term success and sustainable growth.

To learn more about how Love & Company can help your community determine the right entrance fee strategy, contact Wayne Langley at 925-481-8904. Let’s work together to ensure your pricing reflects your value.