Author’s note: This article reflects data and recommendations shared by Dan Hermann and other Ziegler team members during Ziegler’s September 2025 Senior Living Finance & Strategy conference. We greatly appreciate their continuing efforts to support the field with valuable information, and for their permission for us to share this information with you.

In recent years many other senior living field observers have called attention to the substantial potential for growth of not-for-profit organizations. This year, that potential has transformed into an imperative: We need to grow quickly, and we need to do it now. Here are five reasons why.

1. Demand Exceeds Supply

Many communities have already moved forward with expansion planning, and early results have been encouraging. Across the country, not-for-profit Life Plan Communities are seeing strong demand for both new residences and renovated existing ones.

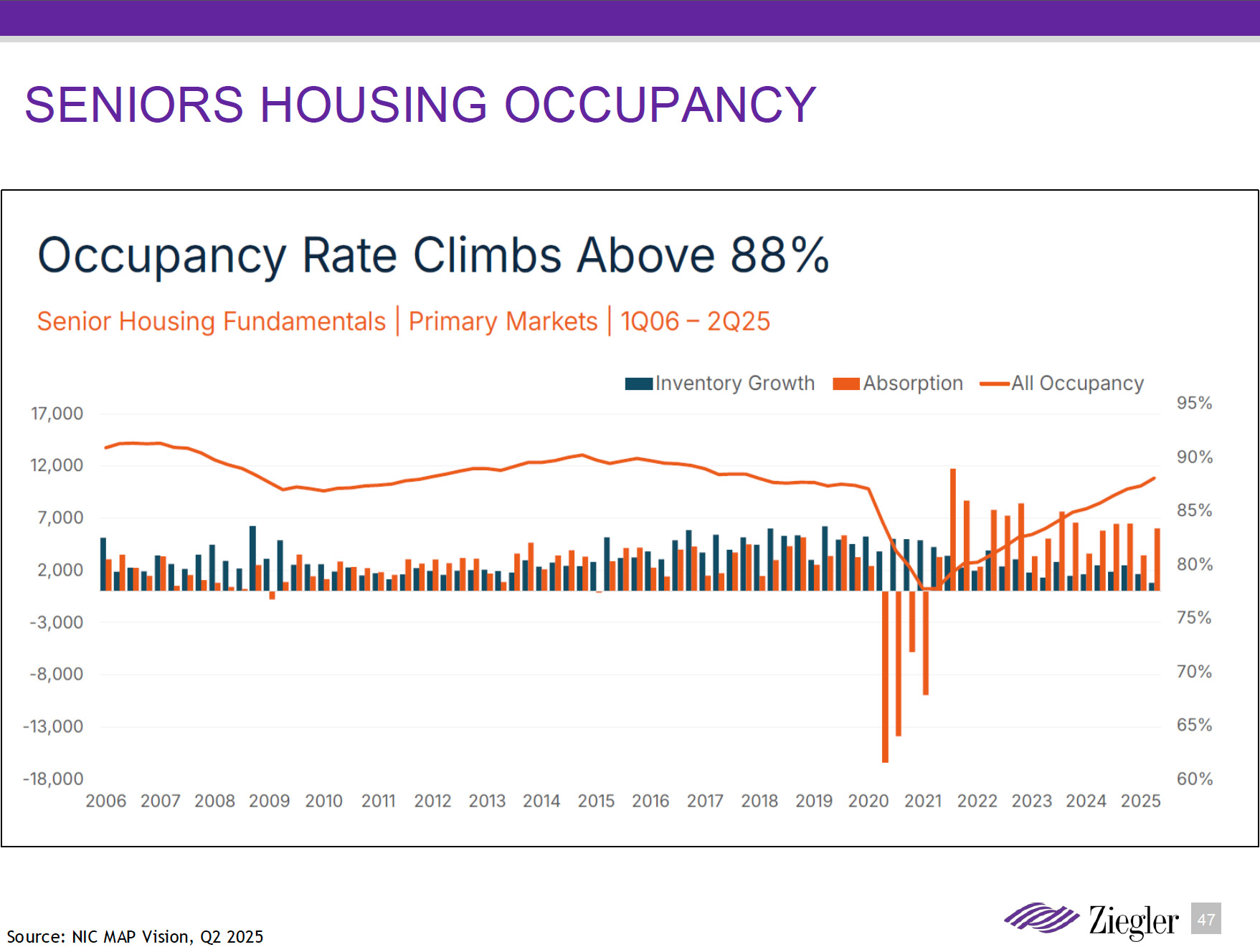

Since mid-2021, however, the absorption of senior living residences has far outpaced the development of new ones. This imbalance—persistent even amid rising construction and financing costs—has reinforced a simple truth: Demand for quality senior living continues to exceed supply.

Since mid-2021, the absorption of senior living residences has been much higher than the development of new residences.

2. We Are Entering a Decade of Unprecedented Demand Growth

We are now entering a 10-year period—2026 through 2035—when the growth of the senior population will be greater than it has ever been. Between 2025 and 2035, millions of baby boomers will turn 75, and this wave will reshape the senior living field. What makes this period especially powerful is that the greatest growth is projected to come from the highest-income households. These are exactly the individuals most likely to consider a Life Plan Community.

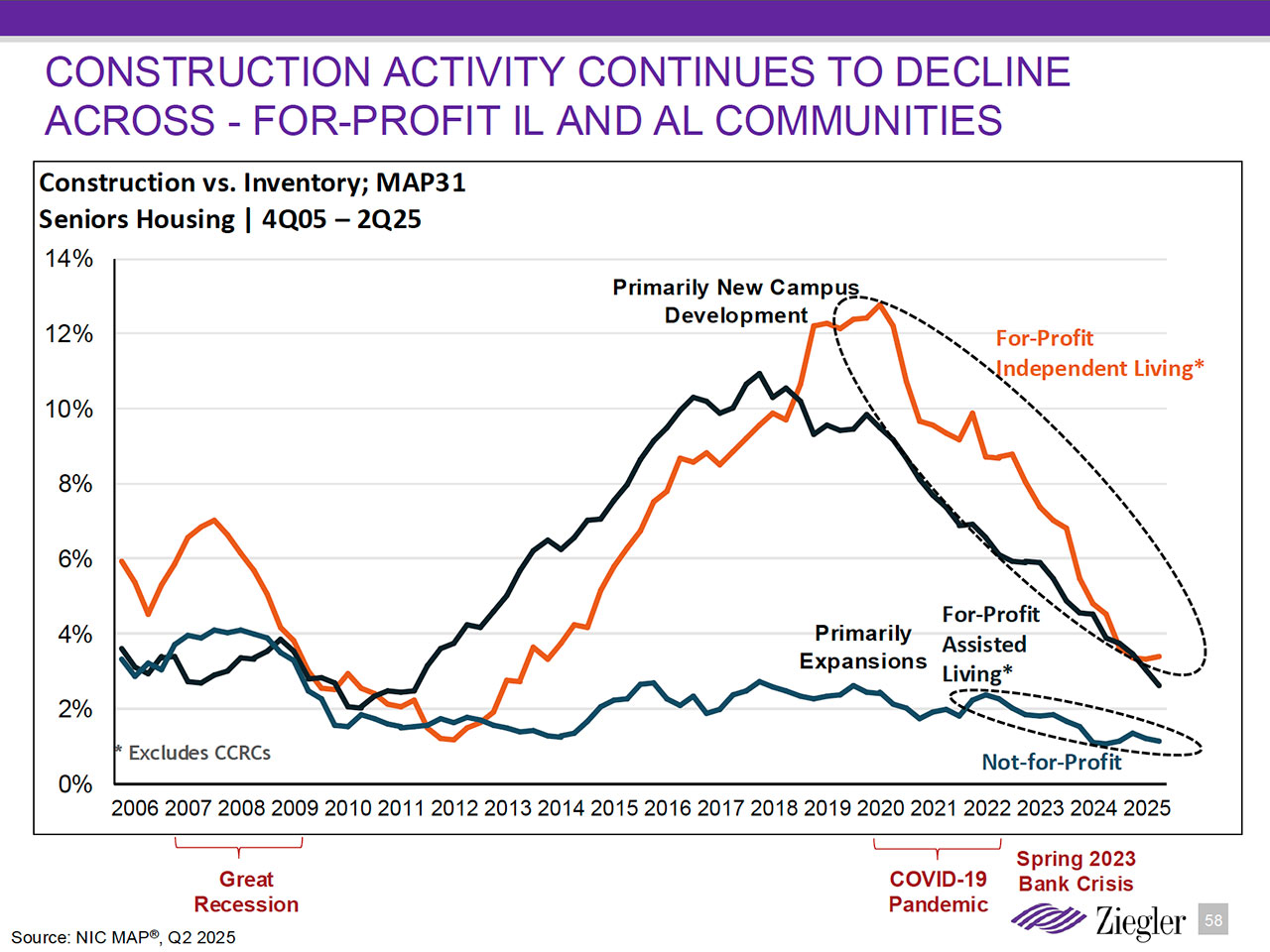

For the not-for-profit sector, this represents an unparalleled opportunity to strengthen market share and expand mission impact—especially as the for-profit side has seen substantially declining growth over the past five years.

Development of new communities by the for-profit sector has declined dramatically since its peak in 2020, creating a major opportunity for the not-for-profit sector to increase its market share. However, not-for-profit growth has been declining, too.

3. Growth Will Continue Through the Rest of This Century

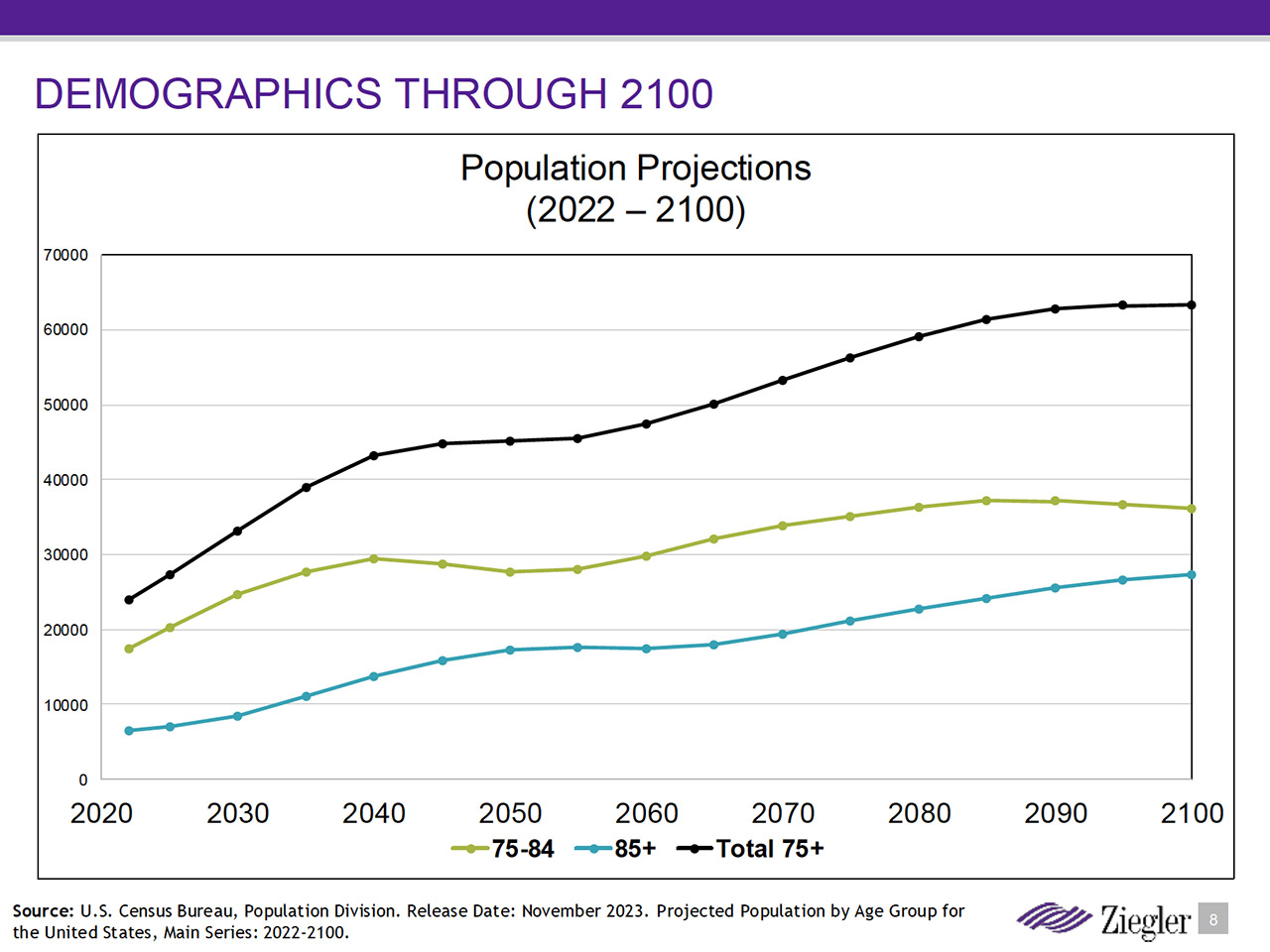

Several times I’ve been asked by community leaders, “But isn’t the population of older Americans going to decline after the boomers? If we build now, won’t we have empty buildings by 2050?”

The answer is an emphatic no. While the rate of growth of the 75+ population will level off slightly between about 2045 and 2055, it doesn’t decline. In fact, it resumes another strong upward climb thereafter. By the end of this century, the number of Americans age 75 and older is projected to be nearly three times greater than in 2020.

So, no, we won’t be building for a shrinking market. We’ll be building for a permanently larger one.

By the end of this century, the number of age 75+ people in the U.S. is projected to be nearly triple the number in 2020.

4. Prospects Can Afford New Construction (And We’re Not Charging Enough for Existing Residences)

Yes, construction costs have increased dramatically in the past five years. But so have home values. For the majority of Life Plan Community prospects, their home equity has grown enough to comfortably absorb the higher entrance fees that new development now requires.

The real pricing challenge for many not-for-profits isn’t about new construction—it’s about existing residences. Entrance fees for existing residences often haven’t kept pace with the rise in construction and renovation costs. As a result, communities may find themselves under-capitalized when it comes time to refresh residences or amenity spaces.

Updating entrance fees to reflect today’s replacement and renovation costs is critical—not only for financial sustainability, but also for maintaining the quality and market appeal that today’s and tomorrow’s residents expect.

5. Interest Rates Are Reasonable

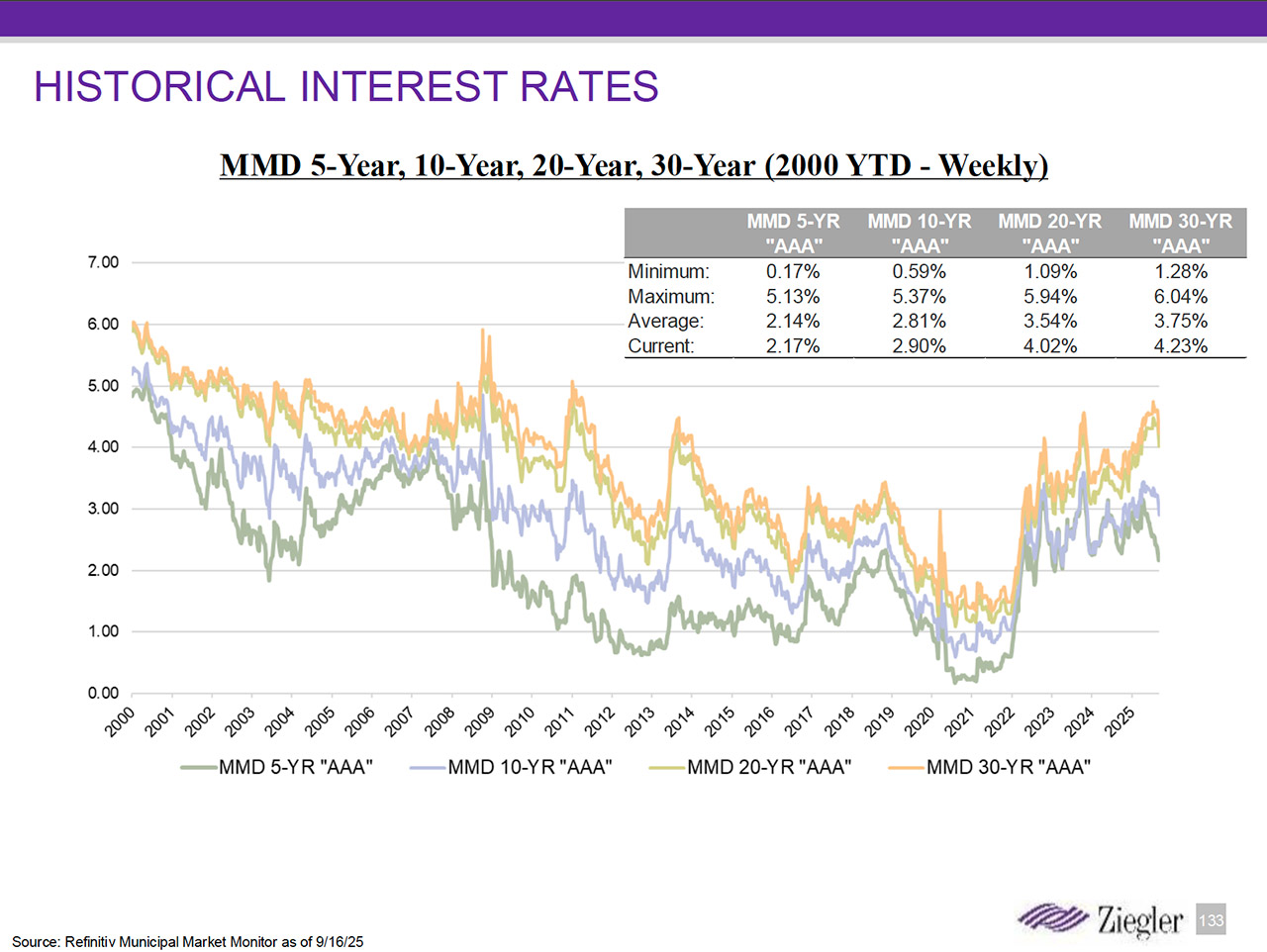

Another frequent concern I hear from boards and executive teams is that interest rates are much higher than they were just four years ago. That’s true, but context matters.

Rates in 2020 and 2021 were historically, even artificially, low. Today’s rates are actually comparable to, and in some cases lower than, what we experienced throughout much of the first decade of this century—a decade that saw some of the strongest growth in not-for-profit senior living.

We thrived in that environment then, and we can absolutely do it again now.

When viewed from a longer-term historical lens, today’s interest rates are lower than the first decade of this century, when there was substantial growth in not-for-profit communities.

Conclusion: Momentum and Mission

The not-for-profit sector has always been rooted in mission, trust and long-term perspective. Those values are more important now than ever. The private sector is building much less than it did five years ago, and demographic demand continues to accelerate. That leaves an extraordinary opening for mission-driven providers to step forward.

Communities that move decisively—those willing to expand, renovate and reprice strategically—are already seeing results. They’re strengthening their balance sheets while meeting the growing demands of today’s and tomorrow’s seniors.

This decade’s growth isn’t something to brace for: It’s something to embrace. The 2020s are proving to be the most consequential decade in the modern history of senior living. Never before have we seen a convergence of factors so favorable for mission-based organizations: an unprecedented demographic surge, rising consumer wealth and reduced for-profit competition.

The message is clear: Now is the time to grow. For those who do, the rewards—both financial and mission-driven—will extend far beyond 2035.

For More Reading and Viewing

Love & Company’s 2026 Senior Housing Trends report is dedicated to helping not-for-profits position themselves to grow and, just as importantly, to transform themselves to meet the changing needs and preferences of tomorrow’s residents.

To dig deeper into the critical topic of growth, download our 2026 Senior Housing Trends report and watch our most popular webinar ever, Look Ahead to 2026 and Beyond: Creating the Community of Tomorrow.