As we close out the third quarter of 2025, the housing market shows early signs of renewed momentum following a sluggish first half of the year. A combination of slightly lower mortgage rates, rising inventory and modestly improving affordability has started to lift home sales across many regions. For seniors considering selling their homes and moving into a Life Plan Community, these conditions remain favorable—especially as home values continue to hover near record highs.

Sales Activity: Modest Gains Amid Improved Affordability

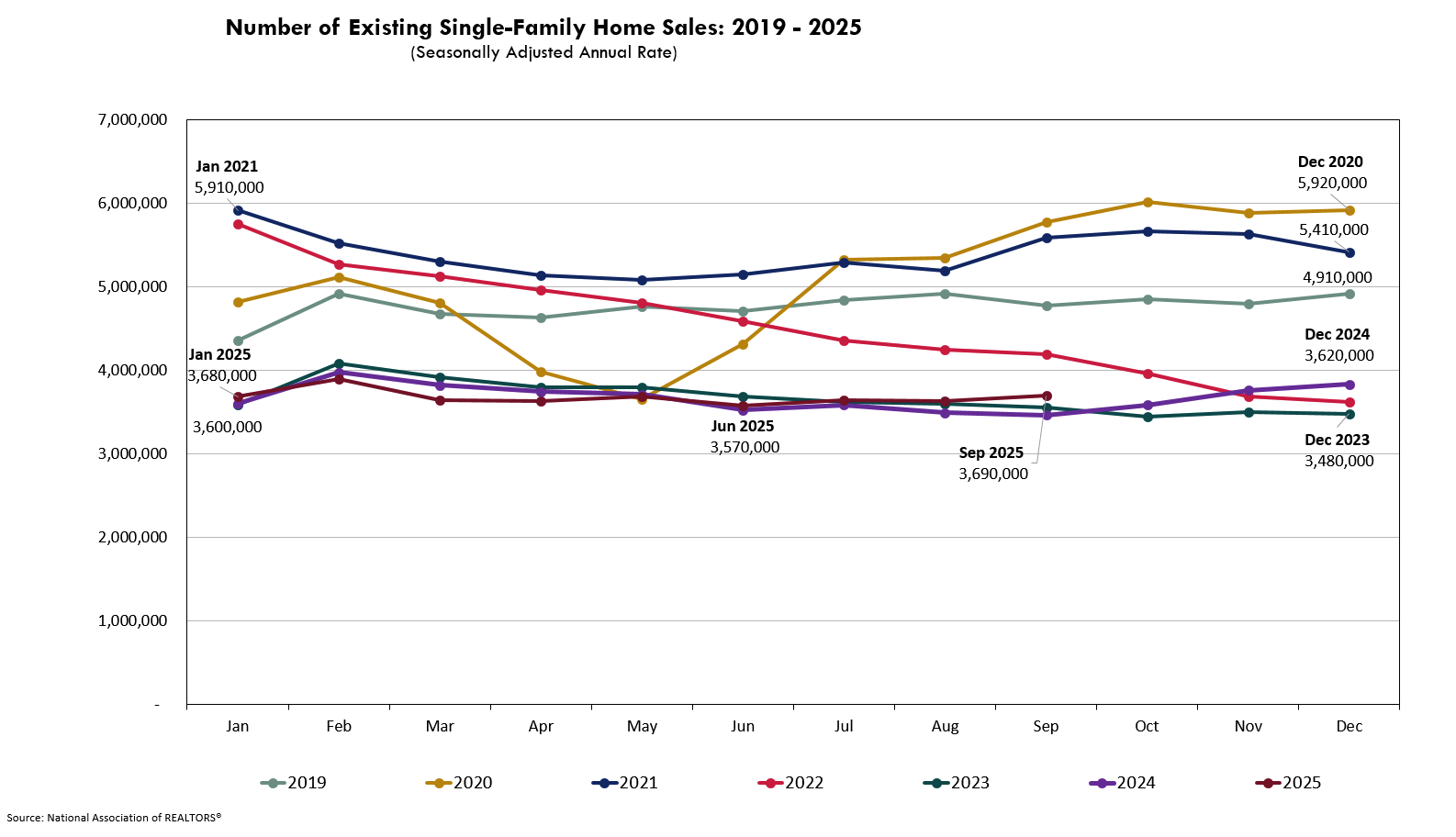

Existing single-family home sales edged upward in recent months, reaching a seasonally adjusted annual rate of 3.69 million homes at the end of September, up from 3.46 million in September 2024. While still well below prepandemic levels, the increase signals renewed buyer interest, fueled in part by easing borrowing costs and a gradual recovery in consumer confidence. Many buyers who had paused earlier in the year are now re-entering the market, responding to improved affordability and more inventory choices.

According to National Association of Realtors Chief Economist Lawrence Yun, “As anticipated, falling mortgage rates are lifting home sales. Improving housing affordability is also contributing to the increase in sales.”

Home Prices: Still Elevated, But Growth Has Cooled

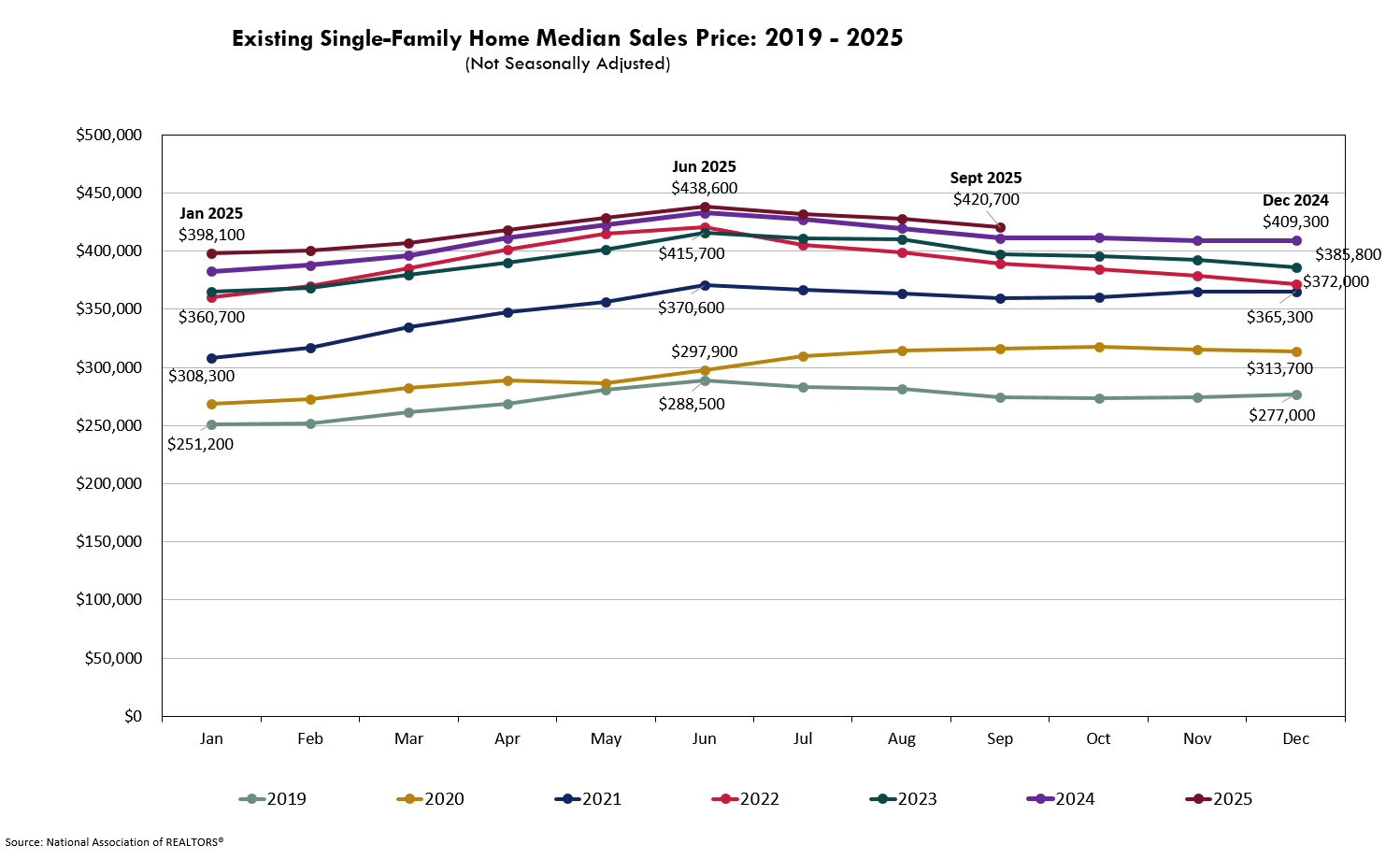

The median resale price for existing single-family homes stood at $420,700 at the end of September, slightly below the June record of $428,800 but still up year-over-year compared to $411,400 in September 2024. For longtime homeowners—especially seniors—this means that home equity remains exceptionally strong.

Dr. Yun noted that, “Inventory is matching a five-year high, though it remains below pre-COVID levels. Many homeowners are financially comfortable, resulting in very few distressed properties and forced sales. Home prices continue to rise in most parts of the country, further contributing to overall household wealth.”

For those who purchased their homes a decade or more ago, accumulated appreciation still translates to a significant financial advantage. Many senior sellers are realizing six-figure gains—often enough to fund the full entrance fee for a Life Plan Community and still retain savings from the transaction.

Inventory & Supply: Slight Softening but Still a Seller’s Market

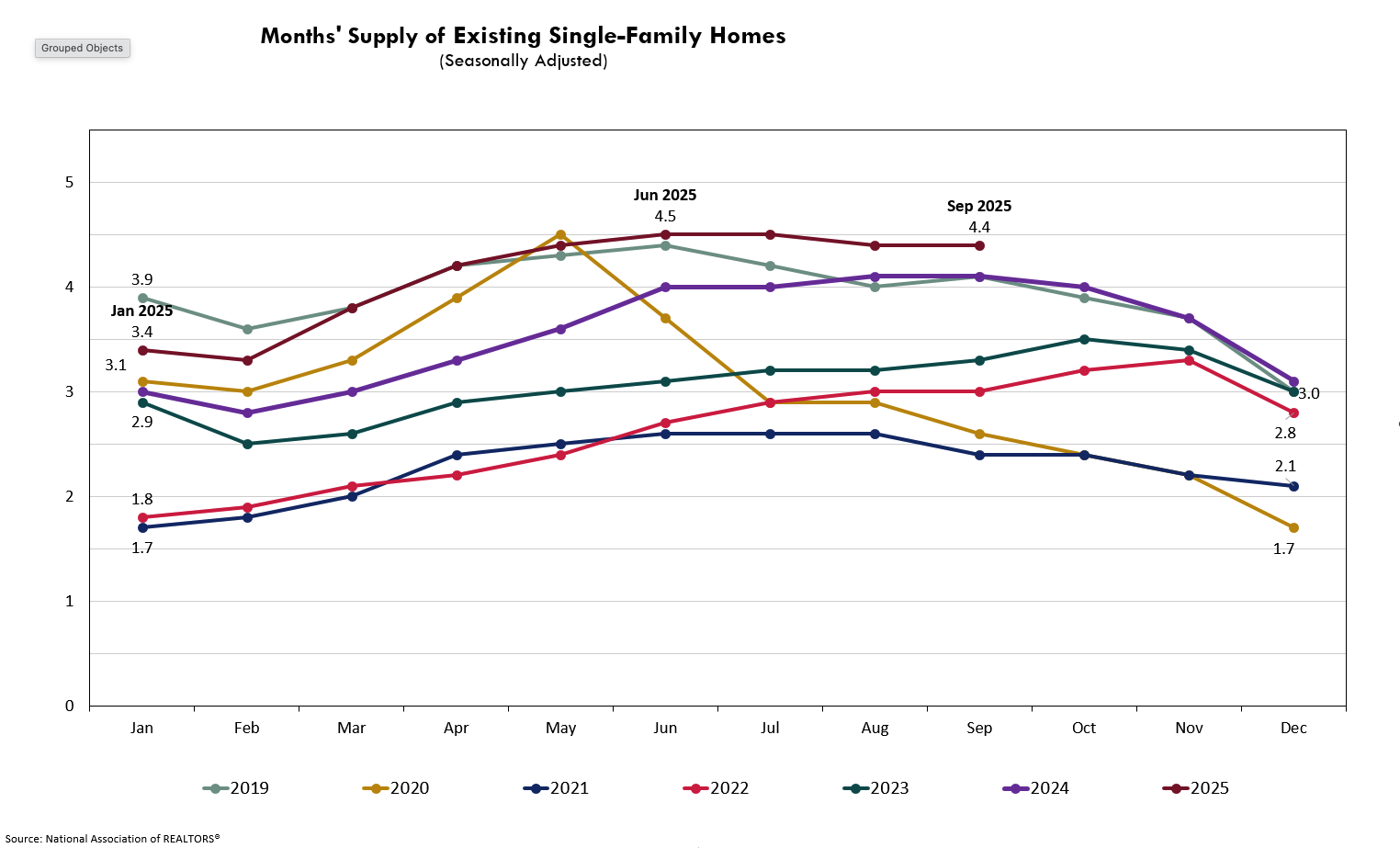

Inventory conditions improved slightly this quarter, with months’ supply at 4.4 months, slightly down from its June and July peak of 4.5 months. While this marks the most balanced level since 2019, it remains just below the five- to six-month threshold typically associated with a neutral market.

Homes are taking a little bit longer to sell, averaging 33 days on market, compared with 31 days last quarter and 28 days a year ago. The shift suggests that buyers are becoming more selective, but demand remains steady for well-priced homes in desirable neighborhoods. Importantly, the share of first-time homebuyers has risen to 30%, up from 26% a year earlier—an encouraging sign that younger buyers are returning as affordability improves.

Mortgage Rates: Easing Offers Relief and Stimulus

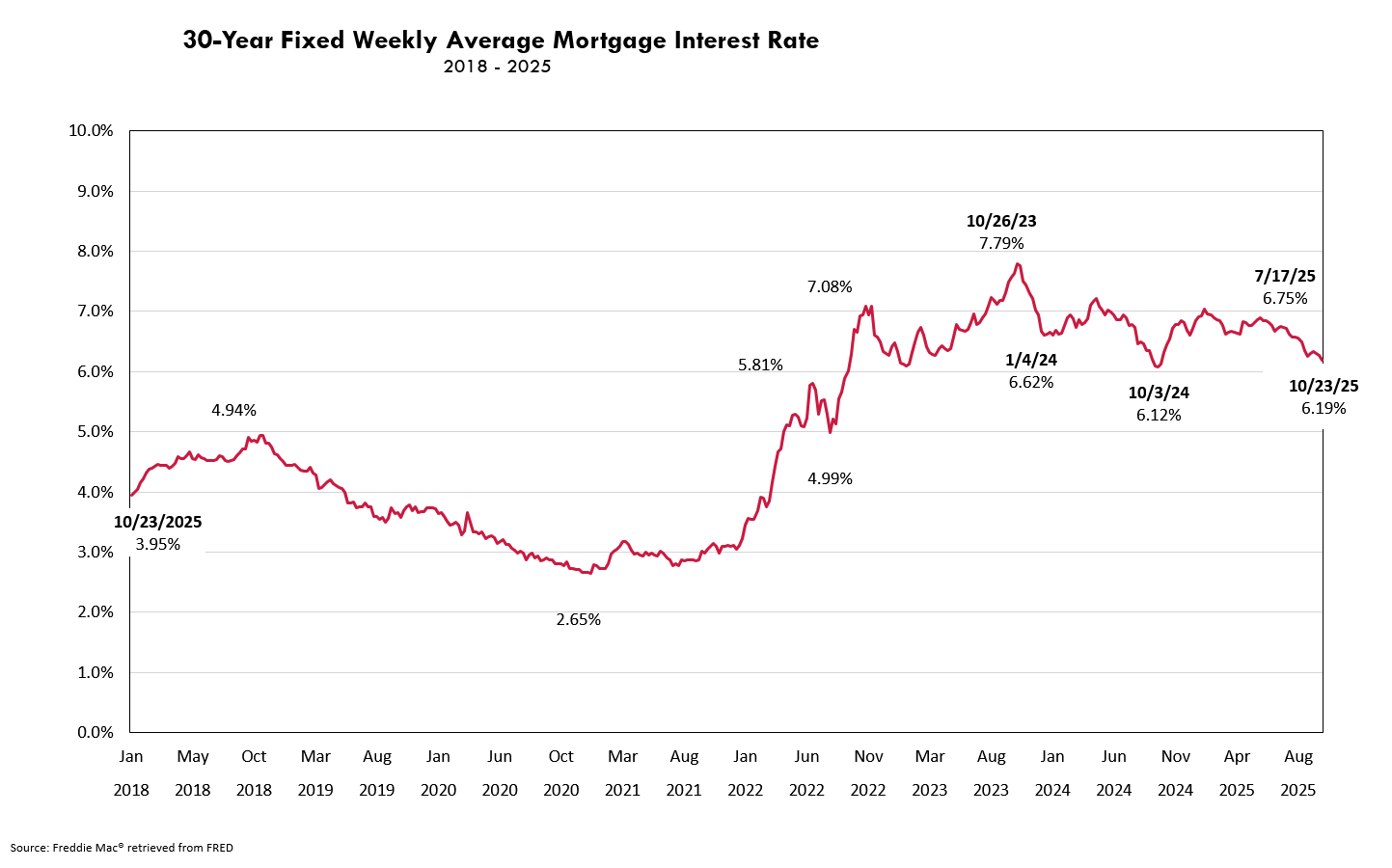

Perhaps the most significant change this quarter is the decline in borrowing costs. The average 30-year fixed mortgage rate fell to 6.19% as of October 23, down more than half a point from midyear levels. Although still high compared to rates throughout much of the 2000s, this decrease is enough to boost affordability and stimulate renewed buyer interest. The combination of price stability, more inventory and lower rates has contributed to a sense of calm in the market—an environment that benefits both buyers and sellers.

If rates continue trending downward toward 6% or lower in the coming months, the housing market could experience a significant increase in activity as we head into the 2026 selling season, creating a strong window for homeowners preparing to sell.

Implications for Seniors Considering a Move to a Life Plan Community

For those thinking about selling their home to fund a move into a Life Plan Community, the current market offers several takeaways:

- Home Equity Remains Strong: Even with a small dip from summer highs—which is normal in the year-to-year cycle of home sale prices—selling prices remain near record levels. Seniors who bought before 2015 continue to enjoy substantial equity gains.

- Slightly Longer Sales Timeline: With inventory levels normalizing, most well-priced homes are selling within about a month. However, higher-end properties or those in slower-moving markets may take a bit longer.

- Growing Buyer Pool: As affordability improves, more buyers—especially first-time homeowners—are returning to the market, broadening the audience for resale homes.

- Advantage of Early Action: Listing before the end of the year may be advantageous if mortgage rates continue to drop. Lower rates attract more buyers and can speed up transactions, helping seniors move on their preferred timeline.

Looking Ahead

While economic uncertainties remain—from inflation trends to potential Federal Reserve policy changes—the overall outlook for the housing market is cautiously optimistic. Modest rate reductions, steady employment and growing confidence among buyers suggest that housing demand will continue to increase gradually as we move into 2026.

For senior homeowners, this means there’s still time to take advantage of strong equity positions and favorable selling conditions. The third quarter of 2025 reaffirmed what many in the field have been saying all year: This is still a seller’s market, just one that’s finally beginning to feel more sustainable.

Final Thoughts

As we look toward the final months of 2025, the environment remains promising for those planning a transition into a Life Plan Community. Home values remain high, market activity is picking up and mortgage rates are finally showing consistent improvement.

For most seniors, that means one thing: Now remains an excellent time to sell—with enough buyer demand, pricing strength and financial stability to support a confident next step in their life plan.

Look for our next market update early in 2026, when we’ll review how holiday-season sales and year-end rate changes shape the 2026 outlook for senior home sellers.