By Karen Adams, VP of Market Intelligence

I review market studies—ours and others’—on a continual basis, typically because someone asks for our thoughts on work they’ve had done, they need a report updated, or I am finalizing one of our own studies. I started developing methodologies for this more than 35 years ago. (Yes, really.) I am also engaged with a group of highly experienced analysts from around the country who monitor and evaluate senior living market research methodologies and trends that affect the work we all do, to assure that we are all recognizing important senior living trends.

Enjoy the article below, and for a deeper dive on senior living market intelligence, please check out the recording of our recent webinar, “5 Ways Market Intelligence Can Help Drive Revenue.”

Two market intelligence themes of value for senior living executives:

A couple of senior living market research themes that emerge repeatedly once again captured my attention while working on a recent project. These are themes that are of value to CEOs, board members, and other decision-makers who rely on market research to make decisions for their organizations.

– Market Studies Quantify Risk.

And when all is said and done, it is the provider/sponsor who assumes it. So, it is both important and valuable to understand the methodologies which you are basing your decisions upon, to pry open any “black boxes” embedded therein, and to determine for yourself where the risks lie.

– The Process is More Valuable Than You Think.

After years of searching for new and improved senior living market research processes, and rarely being at total peace with every step in the calculations, I have reached the conclusion that the process yields as much value as the outcome in understanding a market.

Helpful observations for anyone who is reviewing a senior living market study:

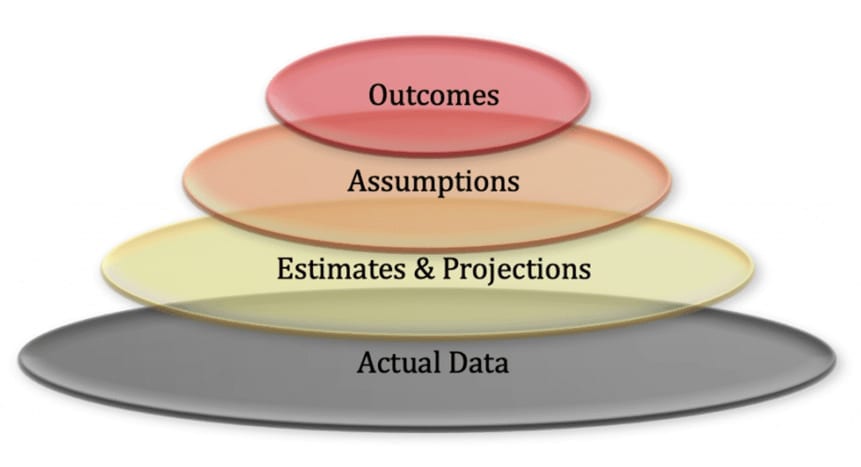

- Market studies are based on a variety of data ranging from actual and current information to estimates and projections and can also include assumptions. For each piece of data, the further you go from actual data the less reliable it is likely to be. Therefore, it is helpful to identify and evaluate whether each piece of data in the methodology is actual data that was collected specifically for this purpose, an estimate or projection, or an assumption. Assumptions bear the greatest degree of scrutiny. Assumptions are necessary to refine key components of your study, but it is essential that you understand where and how they are applied.

- There should not be any “black boxes” in your studies; transparency is an asset. You should be able to follow the rationale and calculation processes so that you understand how conclusions are reached.

- Black Box Theory in Psychology: This black box contains buyer decision processes, which determine their choices. We only have inputs (what we offer) and outward behaviors (do people “buy?”) as indicators of the decision process. The process in the buyers’ brain, the emotions, are rarely, if ever, truly and totally known. Measures of behavior among large groups are frequently applied in senior living market studies (e.g. the frequency of the choice to move to a Life Plan Community or utilization of assisted living). You need to understand the origins and applications of these data and assumptions and how they are applied to better evaluate their value.

What are actual data, what are projections, and what are assumptions?

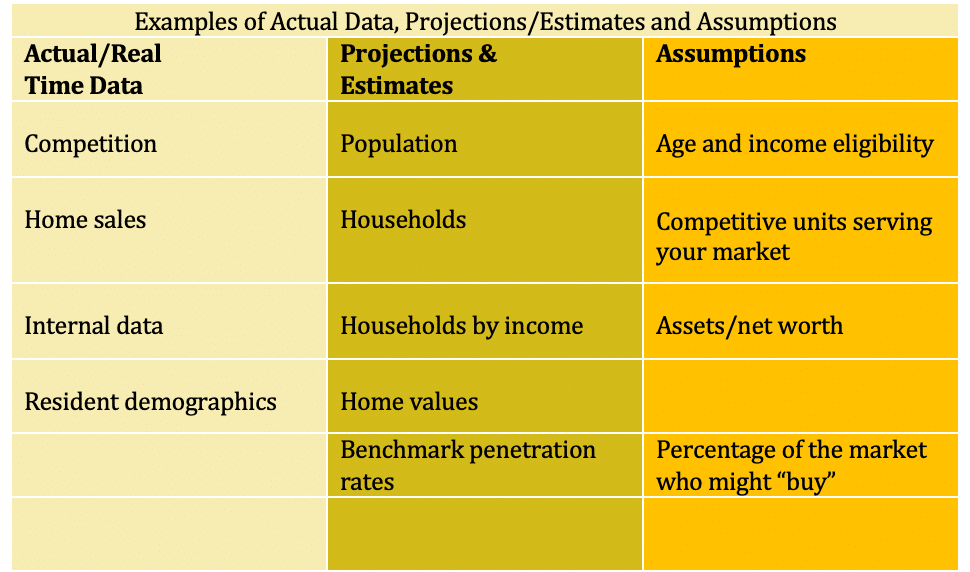

- Examples of actual and real-time data include historic, quantifiable characteristics of residents, data that are collected about competition, home sales, and skilled nursing home market share from hospital Medicare discharges. These data may be current or one or two years old, or older.

- Estimates and projections include data on population and households that are usually gathered by large data companies such as ESRI and Claritas/Environics, which are sample-based counts from census data (including the American Community Survey). These seem to be reliable and are generally developed with sophisticated methodologies. (Right there we have a mathematical black box, and so we trust it to some degree). However, methodologies can go one step further from the original data by creating “estimates,” such as cutting income breaks beyond what are offered in the larger, more sophisticated data sets. This is where simplified methodologies may be applied and these estimates and projections may warrant consideration. At any rate, the methodology used here should be transparent and easily followed in a report.

- Assumptions cover a lot of territory and are probably the most important place to have awareness. Places to look for assumptions and determine your comfort level with each include: the ages and incomes that are used to determine the size of your potential market universe, rates of disability that are applied in assisted living and memory care studies, factors for rates of utilization, distribution of home values across older adult households, and distribution of competitive units across income groups (if at all). The assumptions made in all of these areas can have a substantial impact on the bottom line of “need” and “demand.” Some examples are:

- Most data sources report income by age for households but not the overall population. If a product is better assessed based on population (this is often the case in assisted living/memory care methodologies), what are the calculations that are used to convert population into households and/or to estimate income for population?

- Competition and how it is allocated to quantify the impact in your market is another area where assumptions are necessary and there is no right or wrong answer, only weaknesses and strengths that should be understood.

All product in a market is not created equal

Some is older, some has not been significantly updated, some may carry less debt and some communities may still be offering very small accommodations therefore making some stock available to moderate-income market segments, while newer and/or larger options may only be accessible to households with higher incomes. How are these allocated in the assessments of “penetration” or calculations of potential unmet “demand?”

If your proposed product is serving primarily very high-income households, are units that are affordable to households with incomes below your targeted audience allocated into or out of competitive counts, and if so, how? Determining how to allocate units can provide an enhanced understanding of the dynamics of the market, making the process itself valuable.

At Love & Company we search out every possible data source to understand the unit size and mix of communities to be able to allocate competitors among income groups. Nevertheless, the” psychology black box” still exists. Lower-income households are more likely to occupy smaller residences, but we also know that there are higher-income individuals who purchase prudently.

It is vital to acknowledge if the allocation is based largely on assumptions rather than some type of data, and if it is data-based, ask how those assumptions are applied, because every degree of separation from real data to outcomes increases risk.

Ultimately the provider accepts the risk for any project, therefore identifying and evaluating each of the following can enhance both your risk-taking skills and your understanding of the market being evaluated.

Your organization should ask the following questions, and keep in mind its risk tolerance, when basing organizational direction off a senior living market study:

- What are actual and real-time data? Are there any other sources of real-time data that might be utilized?

- What are the sources of estimates and projections? How solid are they?

- What are the assumptions in the study? Are you comfortable with them? Should brackets be created to test the impacts of various ranges of those assumptions? In other words, should sensitivity analyses be undertaken around those assumptions?

Understanding historical data, methodologies and assumptions

And speaking of the psychology black box, historic data exist that senior living market research studies can apply to the utilization of Life Plan Communities. This all manifests itself in the form of the percentage ranges of markets that are likely to opt for these products. By contrast, this is not so for “active adult” rental product; a fast-growing area that adds a whole new dimension with regard to targeted age groups and the assumptions that are applied to setting “capture” rates. Similarly, utilization rates of assisted living and memory care are far less solidified in currently available data.

There are a variety of other data that are often applied to senior living market analyses. The source and any methodology for adjusting those should be transparent, and the rationale behind calculations should be offered by the analyst.

The fact is that senior living market research methodologies vary in how they account for key factors in the markets. No methodology is perfect because they are based on a variety of data sources, many of which were developed for other purposes. Finally, the purpose of the study usually affects the methodologies that are applied to it.

At Love & Company we work hard to identify as much real-time data as possible to bring us as close as possible to actually measuring every important element that needs to be considered – and filling the gaps with the most thought-out set of assumptions possible. Through that process we come to understand a great deal about the markets and where the strengths and weaknesses lie in that understanding.

—

To dive deeper into senior living market research for your organization, especially if you’re on the brink of an expansion or a new venture, contact Tim Bracken at 410-207-0013 or click here to set up a time on his calendar.